Absent Trump-like Protections British Steel is Collapsing, Threatening 25,000 Jobs

Full disclosure, I detest tariffs.

An education in economic policy and business analytics, as well as observational experience of historical transpirings has reinforced a core ideology that free markets and free trade are – in a near perfect world – the absolute standard to strive for in international commerce.

But the global economy of 2019 is very far from perfect, replete with countless economic actors that don’t play even close to by the rulebook of classical liberal economics (think Adam Smith) like the US strives to.

The influence of foreign actors, from subsidies and tariffs imposed by fellow democracies like Canada and the members of the EU, to hardline government interventionism from regimes like China, has an undeniable negative effect on domestic industries playing by the limiting rules of free trade.

In some ways this is expected, as the only way for many foreign firms to compete with American economic muscle is with these protective barriers. China, for their part, won’t even import many American products, like Google software and devices or certain crops. Canadian dairy would be overwhelmed in months, maybe weeks, if American counterparts weren’t kept at bay.

While economists steadfastly argue that free trade is worth striving for even with these international obstacles in place, for blue collar workers losing their steel mill jobs, maximizing net economic utility is a lot less important than being able to put food on the table.

And really, that dichotomy between academics and the ‘boots on the ground’ as it were is where Donald Trump saw the opportunity, if not necessity, to partially shield a dying American industry from unfair competition. Trump famously coins his path to be ‘fair trade’ over free trade.

If the UK’s imploding steel industry is any indication, that protection was well warranted and saved countless jobs. Currently across the Atlantic, a steel industry crisis is in full swing as the UK’s second largest steel producer ‘British Steel’ plummets towards total insolvency as foreign competition, including that revitalized American steel industry, shatters their competitive edge. The BBC reports,

“British Steel has been placed in compulsory liquidation, putting 5,000 jobs at risk and endangering 20,000 in the supply chain.

The move follows a breakdown in rescue talks between the government and the company’s owner, Greybull. The Government’s Official Receiver has taken control of the company as part of the liquidation process.

The search for a buyer for British Steel has already begun. In the meantime, it will trade normally. The Official Receiver said British Steel Ltd had been wound up in the High Court and the immediate priority was to continue safe operation of the site.

The company was transferred to the Official Receiver because British Steel, its shareholders and the government were not able to, or would not, support the business. That meant the company did not have to funds to pay for an administration.”

But Stateside, Steel is Looking Up

While domestic steel in the United States has had far from an easy route since Trump’s economic protections saved them from total eradication – with shares in steel firms widely plummeting after a bout of overproduction – the industry has undeniably been rescued from an impending demise by the Trump tariffs; if only for a time.

Absent the controversial protections erected by the administration, US steel firms would be facing the exact same crises as their British counterparts thanks to developing and state-managed economies like China flooding the markets with cheap imports to drive out competition. In fairness for their own part, the British mills have been under assault on all sides as the UK’s floundering ‘Brexit’ negotiations induce spiteful EU members to cut out British steel imports altogether.

But in the United States, things are looking tentatively optimistic for a steel industry previously suffering from decades of abuse from the globalized market.

CNN Business is even forced to accept the undeniable industry revitalization post-Trump protectionism in the steel sector admitting,

“Steel mills reopened, adding about 9,000 jobs to the industry. Existing mills also increased their output. More domestic capacity could be on the way. American steelmakers have announced plans to spend billions of dollars to increase capacity by 10 million tons annually since the tariffs were announced. Nucor alone has said it will spend more than $2 billion to add more than 2.6 million tons of capacity in the coming years.

The tariffs encouraged American steel companies to increase investment beyond simply increasing capacity. The steelmakers argue they needed to make the investment to be competitive for the future.

For example, US Steel announced this month that it is it is spending $1.2 billion on a new kind of steel mill that turns molten steel directly into thin sheets of steel on rolls. That technology would eliminate the step that steelmakers have used for more than a century to pour steel into thick slabs, let newly formed slabs cool and then reheat those slabs to press the steel into thin rolls. US Steel’s plant would be the first in the country and one of only a few in the world.

“We’re now pivoting from playing defense to offense,” said CEO David Burritt.

Tariffs still are far from a desirable economic tool, and their use can never be considered lightly. But when economic competitors aren’t playing by the rules of free trade perhaps Trump’s ‘fair trade’, tariffs and all, isn’t the economic cancer many market players and academics warned it would be.

In fact, if the collapse of British Steel is any indication ‘fair trade’ may very well have saved countless hardworking Americans their livelihoods.

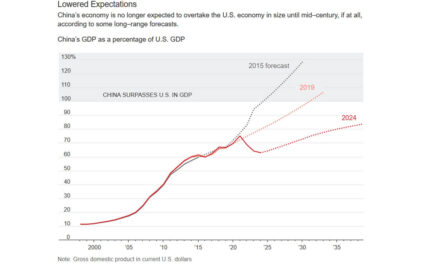

Editor’s note: There is little doubt that Trump’s tough negotiations with China are having ramifications all over the world, and they are affecting more than just America. China knows that it can target our friends and we will be sympathetic. They believe this could be our weakness.

But China has been at war with us for a long time, without our leadership having the guts to recognize it. China’s economic power is largely based on technology they stole from us, and markets they have cheated to acquire. Trump is the first political leader (in the world) to have the business acumen to recognize how China has cheated and to have the guts to take them on, head on.

China hopes, and could be on the path to become the country with the biggest economy, with the biggest military, and the most influence. Is it too late to maintain our lead? In ten years, it will be.

Trump could be our last hope.

I believe President Trump honestly has America’s interests at heart and he will act accordingly. He is the right person at the right place at the right time. I can’t say those two sentences FOR ANY OTHER PRESIDENT !

You’re right

The burning question here is: Why did our previous leaders sell us out and not confront China on their cheating and stealing? Were they simply too stupid to see where that was leading us or were there more sinister motives involved? History will tell all at some point in the future.

Phil in TX