Why Biden cannot sell his great economy

Recently, President Biden clenched his fist and emphatically yelled – yes, yelled – that America has the best economy in the world. That makes sense to politicians, economists and Biden supporters. It makes sense to the wealthy, who worry more about the value of their investments and stocks than the cost of their gas, cars, mortgages and groceries.

It was recently reported that Biden was asking his staff why the folks back home are not appreciating his great economy. I doubt anyone told him the real reason. They probably said things like, “we need better messaging.” Or “It will take time for the people to feel all the benefits.” Or “The media is not telling the people.” (That is a laugh when you consider how often Biden’s friends in the Fourth Estate keep promoting his version of the American economy.)

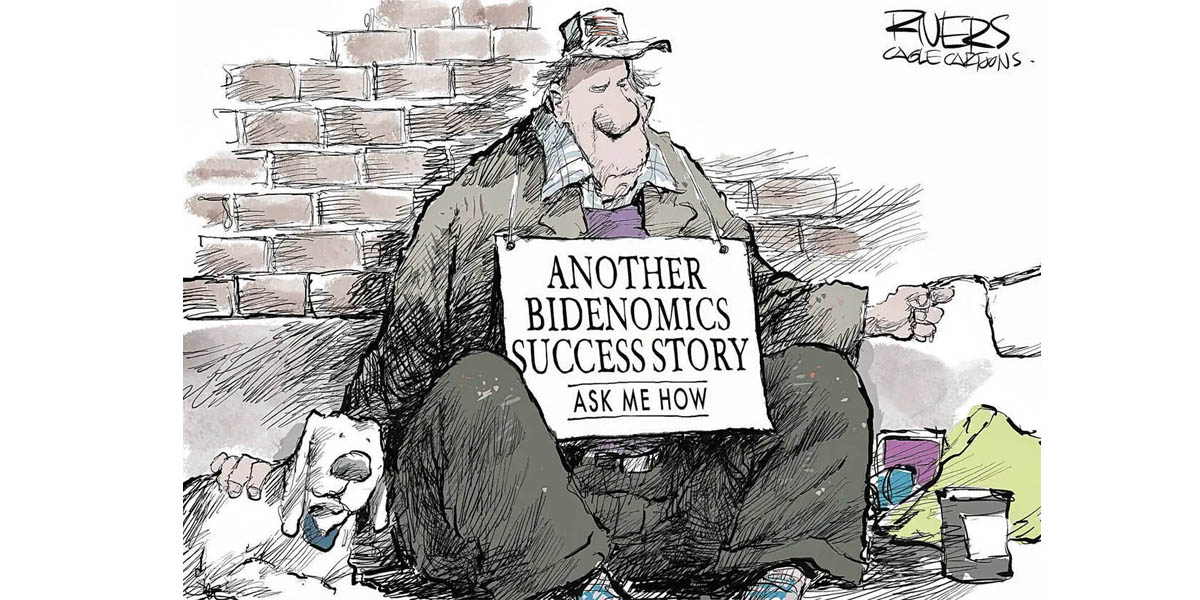

So … what is the real reason that the folks back home are not praising Biden on the economy as much as he praises himself? It is because they are not living in his rosy economy – and he is tone-deaf. We know he is tone-deaf because he keeps wondering why the people do not like his economy. They like the Trump economy better – according to virtually every poll. That just frustrates the hell out of Biden.

Mr. President. Here is your answer.

Those folks back home are not living in the economy you see or in which you and your friends live. They know the Gross National Product is good if it is growing, but where is the impact on their lives? They believe that creating new jobs is a good thing, but how does that relate to them? They hear you talk about the American economy being the strongest in the world. But they are not comparing their situation with some guy or gal in Italy. For families, economics is not a competitive issue. It is not a national issue. Those are headlines, but they are not the story.

For every individual and family in America, there is only one economy that matters. It is their personal economy – their family budget. Like a business financial report, people see their economy as their personal balance sheet – listing income on one side and expenses on the other. And they do not need professional accountants to do the books every year. It is in their head and in the bank accounts every day. They do the calculations every time they go to the grocery store.

More than two-thirds of Americans are living paycheck to paycheck. That means no savings. No putting money aside for those inevitable “rainy days.” No money for the kid’s college tuition. No money to purchase a home or a new car. No money for vacations. No money for retirement unless it is an employer provided. In fact, 13 percent of working Americans have no retirement funds.

Why do they see the Trump economy so much better. Because for them, it was. They tell us that in the polls. On average, two-thirds of voters believe Trump is better at handling the economy – their economy — than Biden. And there is a reason for that. They believe they were better off financially under Trump.

Ironically, Biden’s great economy is benefiting from the folks who are suffering. They have been contributing to those big -picture numbers – GNP, Jobs Reports, etc. – that Biden constantly refers to. Despite the high costs, people are using their money to purchase a lot of stuff. Consumer spending is driving the economy. Oh … did I say they were using their MONEY. Not so. They are using their credit cards – and while that helps Biden’s economy, it is crushing the personal economy.

It was recently reported that personal credit debt is at an all-time high of $1,13 trillion. That is an astonishing $50 billion increase in just the last quarter. The delinquency rate has risen by 50 percent in the same period.

The problem is compounded by the fact that interest rates on credit cards are averaging 21 percent – with many card holders paying much higher interest. (I recently received a solicitation for a card with an APR of 24.24 percent – and I have good credit.) Millions of card users will not qualify for the 21 percent average.

What is going to happen when consumers inevitably run out of credit? When can they no longer support Biden’s house-of-cards economy as consumers? Economic slow down? Stagflation? Recession? Whatever it is, it will not be good for the folks sitting around the kitchen table.

The credit statistics confirm that millions of Americans are falling in the credit trap – in which they can hardly afford to pay off the monthly interest. Getting debt free becomes a virtual impossibility. That means defaults, lower credit rating and higher credit charges in the future.

Having a job is not working for a lot of people. Since Biden took office inflation has driven costs up 18 to 19 percent. Wages over those years increased 16 to 17 percent. That means people today have less buying power than they did at the end of the Trump presidency. Even worse for them is that the inflation rate for the essential purchases – food, medicine etc. – is closer to 25 percent. That is what the folks back home are seeing and dealing with every day.

Inflation went up 3.1 percent in January – more than economists predicted. That means it is unlikely the Federal Reserve will lower interest rates. The news triggered a sharp decline in the stock market. Economists provided complicated – and often conflicting – explanations. But for the average person, it simply means the next trip to the supermarket will cost more than the last.

Biden touts his support for union pay increases. One can debate if they deserved increases — or how much the increases should be. But the one thing that is for sure is that those pay increases will eventually be reflected in the retail price tags. The significant increase for auto workers will be seen on the sticker price.

Biden can continue to brag about HIS economy, but he cannot jawbone what the folks back home are experiencing in THEIR economy. That is why all the talk about the great economy Biden has given us falls on deaf ears. The people know better.

So, there ‘tis.

I blame this all on the Media. As they say in showbiz, a great act is hard to follow.

Well if anyone payed HONEST attention to the Trump Presidency, they would have realized he did a fantastic job.

In stumbles Biden actually believing the Crap spewed to him for idiots and haters not wanting to see the truth.

The only way for Biden to go is down. And he did, with the help of Republicans like Liz a Bitch Cheney.

Fast forward & there you have it. A buss driving off a cliff while everyone is to busy congratulating themselves

for sewing Trump.

FOOLS, Democratic FOOLS.

And we all Suffer!

I feel your pain Darren. It’s the best I can do since I can’t copy your pain.

Too much money = inflation

Too little money = recession

Recession = 2q’s of negative gpb. It’s a rear facing statistic telling you what you already have known for two quarters.

We overheated with the Trump/Biden free money programs.

The Fed is raising interest rates, this “takes” money out of the system.

We have been triffling with recession, but continue to have gdp growth, there is still a lot of money in the system.

M2, the money supply, peaked in 4/22, has come down a bit, but stands pretty stable since then. IOW, some people have less money, some don’t, but overall the money supply has not shrunk as much as the rate drops. It’s causing a soft landing recession, but nonetheless, some individuals are not seeing it. That’s just facts, not much to debate on that.

So, there is a technical reason that some people feel left behind, they are left behind, and it hurts. Free money is much easier for individuals to deal with. Tighter money is harder, especially if you don’t make right moves to mitigate. Recovery is uneven and some are being left behind and miss the free money. Especially if their spending stays the same as when there was free money. And if you are caught spending what you earn to begin with, you are in real trouble, you have to give up something you enjoyed when money was free. And if you are poor enough to HAVE to spend what you earn on survival, you are in real trouble.

Personal annectdote for Tom who likes to know how I am doing $$$$: under Trump I both prospered and lost, with 3q’s of loss starting in 4q19 throught the middle of 2020. It was chaotic and did not make practical sense. I did not have as much “free money” as some in that I gave a lot away. I did not think it fair to take money I did not deserve or need during covid and gave it to others who needed it more. Around then I pulled most equities and invested in fixed income which lost a lot of value to my portfolio. My peak was 4q21, and then I lost for 4, maybe 6q’s in a row. Four for sure, but not sure of the 6 due to a databreach where I lost a couple of q’s of data. The last two quarters under Biden have been positive and if I nail one more, and I should, I will pierece my all time high from 4q21, both under Biden. For me, the difference is Trump was a series of highs and lows, the highest came under Biden, but was fueled by Trump, and since then, Biden has been pretty much steady, slow progress. It was unstable, crazy, and I could not forsee what would happen next when he tweeted entire industries up or down.. Meanwhile, I spent and still am spending like a druken sailor on shore leave. Frankly, more than I make as I clean up this home for my next move.

So, I did OK under Trump, but the financial chaos was difficult to manage and he killed me on the taxes. I lost my 6K WAH deduction, over 10K on property tax deductions, my tax rate close to doubled, mostly because it was so damned low with education deductions, wah, property, and other now lost deductions. I don’t mind paying my fair share but the rapid change hurt for sure. I have rebounded, financially don’t care about the chaotic market fluctuations right now, and have righted the ship to sail ahead again. But certainly some spending changes like resturants way down, mail-order foods and meals — way up, grocery — the same. Most of my bills stayed about the same, minor inflation boost or many are even lower —- but I work at that…. Whining about bills, it’s what I do.

I am OK under Biden and the increased economic stability has benefitted me personally but I can see where if I had stayed in equities, I would be caught on the wrong side of the stick even with the total market numbers as high as they are. When the market is driven by AI, you know the market has some issues still. I consider myself lucky, can see where IF I had made the RIGHT stock moves, I would feel much luckier, but also IF I had made the wrong moves which was more likely, I would be in deep kimche right now. I am making more, saving more, but spending more which this year must stop due. Hope I don’t help cause the next recession……

So, I understand while those playing close to the bone financially are hurting, those who enjoyed free money perks are missing those perks or going into hock for them, those playing the market may be in deep kimchee even with a strong market, on aveage, and I am just chuncking along —- not great, but not bad either. And I like the stability.