You should be Thankful for the One Percenters

The Supreme Court hearings and the mid-term elections seem to have redirected the hate away from the one percenters for the moment. The alpha to the omega to the deplorables, the rich are just as despised by the liberal left. Except those who are themselves one percenters, of course. The numbers put out by the Congressional Budget Office might have you believe that the tax system is set up so everyone pays their fair share. In 2016, $1.44 trillion in income taxes were paid by 140.9 million taxpayers reporting a total of $10.2 trillion in adjusted gross income, according to data recently released by the Internal Revenue Services.

According to several statistics compiled by Bloomberg, there are a handful of people carrying the majority of the country on their coattails.

- The top 1 percent paid a greater share of individual income taxes (37.3 percent) than the bottom 90 percent combined (30.5 percent).

- The top 50 percent of all taxpayers paid 97 percent of total individual income taxes. In other words, the bottom 50 percent paid 3 percent.

- The top 0.001%, or about 1,400 taxpayers alone paid 3.25 percent of all income taxes.

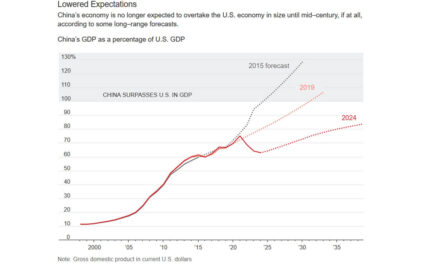

Just to make sure you are following along boys and girls, 1,400 people paid as much income tax as 70 million people, the bottom 50 percent. That’s what one would call a progressive tax with a capital “P.” The progressivity curve since the turn of the century:

The individual income tax is designed to be progressive, those with higher incomes pay at higher rates. A Pew Research Center analysis of IRS data from 2015, the most recent available, shows that taxpayers with incomes of $200,000 or more paid well over half (58.8%) of federal income taxes.

It’s usually the ones who yell the loudest are those who don’t pay anything. According to data for the 2015 tax year from the Tax Policy Center, a nonpartisan Washington-based research group, roughly 77.5 million people will pay no federal individual income tax. Roughly half pay no federal income tax because they have no taxable income, and the other roughly half get enough tax breaks to erase their tax liability, Albeit, this does not stop them from hating capitalism and the wealthy. The contempt for corporate America doesn’t stop there. Most will yell that large corporations pay no taxes and get all of the tax law benefits. In fact, more than 80% of the tax breaks identified by the Joint Committee go to individual taxpayers. The mortgage-interest deduction, for instance, was valued at $63.6 billion, while the deductions for individual charitable contributions of all kinds cost the government $56.9 billion.

The most extensive rewrite of the U.S. tax code in more than 30 years was signed into law in early 2018. Individuals may start to feel the effects of last year’s tax overhaul when they file their returns this April. When you hear the fake news tell you why the rich are getting the biggest benefits, now you know why.

Seems like it's the email from a vet confessing it all. But your whining is telling us something. Could be…

First, Beyond whatever your opinion, Larry, there stands Pres. Jimmy Carter in America's History and his legacy says he was…

this needs further investigation. there is a lot here. we need to have open minds looking at this. and I…

PBP emails you? How odd. I understood your English perfectly. Again with the alluding fantasy. I said what I said…

Frank, I did not say you ever sent me an email I said I have saved every single email from…