Biden’s Tax Hikes Are Here

As millions of Americans face unprecedented financial hardship as a result of the coronavirus pandemic, the Biden Administration is weighing a range of tax increases and other fees to help fund a massive infrastructure plan that could cost up to $4 trillion.

The Administration will repeal “a lot of” President Donald Trump’s tax cuts, said Senator Joe Manchin (D-WV). It will also increase the corporate rate to “at least” 25%.

“One of the items that he spoke about in his Build Back Better agenda was making sure that people paid their fair share – whether it’s highest income or rolling back some of the corporate tax cuts,” said White House Press Secretary Jen Psaki.

In 2018, President Trump’s Tax Cuts and Jobs Act reduced the corporate tax rate from 35% to 21%. This spurred businesses to return to the US and increase wages and benefits for their workers.

Biden’s tax hikes will increase the rate to 28%. Combined with state taxes, that would see American corporations paying 32% (one of the highest rates in the developed world).

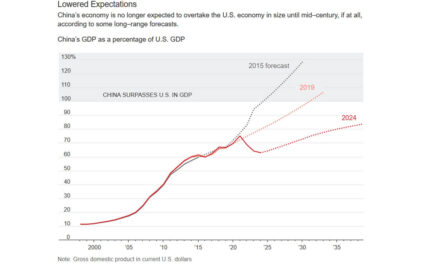

With a higher tax burden, American corporations would have an incentive to send jobs overseas and partner with foreign companies to decrease costs. According to the Tax Foundation, the increased corporate rate would reduce GDP by 0.8%, cut wages by 0.7%, and eliminate 159,000 jobs.

The change would also affect anyone invested in the stock market, including individuals with 401(k)s and IRAs.

Treasury Secretary Janet Yellen has promised to wait until the threat of COVID to the economy has passed before implementing any of Biden’s major tax hikes and says she isn’t worried about inflation.

Additional methods under consideration include:

- Taxing capital gains as ordinary income

- Capping deductions for high earners

- Imposing the Social Security payroll tax on wage above $400,000

- Implementing a carbon tax

“The president believes that there is a path forward on a range of issues where there’s been a history of bipartisan support, including infrastructure,” said Psaki. “Infrastructure improvements are not a Democratic issue, they’re not a moderate issue, a progressive issue, a conservative issue. The American people want their roads, rails, and bridges to be reformed. He feels there’s a path forward.”

Sources:

Biden tax hikes would likely phase in slowly, Treasury Secretary Yellen says

Op-Ed: Biden corporate tax hikes will send jobs overseas

Biden Mulls Funding Infrastructure Plan With Tax Increases, Corporate Tax-Cut Rollbacks, New Fees

Alice, wait until you find out about trump’s structuring of his party’s tax cuts! They will expire for all of us but the richest Americans very soon.

I’m sure you’ll be up in arms about that also.

Notice the 1% are also the politicians, but they have loopholes so they don’t pay anywhere near their fair share. Let’s get them on the same page as ordinary citizens. You pay for your own medical, social security, perks, housing etc. see how fast they change the laws.

You do know the rich you disdain pay 90% of all collected income taxes. Corporate taxes are a different animal as are retirements like 401k’s. Jealousy of those with extreme wealth is never a good look. You act like those people never took a risk with their money, never built a business and certainly DON’T DESERVE the fruit of their labor. I know several very wealthy working people, a surgeon in fact who makes @1-2 million a year. You know how much he pays in taxes? I bet not.he pays 55% in income taxes. That’s not enough for you? He pays $500,000 a year in malpractice fees, he pays the SS taxes for his employees and salary out of that total income. He gets calls all night long etc. yet according to you, he isn’t paying his fair share.

What you want is based on a lie peddled to you for years as a political tool to garner your vote and create division amongst us. Anger that someone has something you don’t and it’s not fair. It’s still true today that anyone can become millionaires. What decisions you make in life also determine if you get to that point or not. Many people next door to you are multi millionaires but you can’t tell.

How about demanding the revered Hollywood loud mouths who tell you the rich aren’t paying their fair share, how about they put up or shut up. There is no law that prevents anyone of paying more taxes than law requires.

You think that many wealthy should not in old age recoup the money they were required to pay into SS and Medicare? That’ would be stealing above the stealing by the government. What you want is something for nothing. If you want tax relief and a better shot, try not supporting the big tax and spend party. Many of them in power positions for over 30 years have lined their pockets with a type of insider trading. They make the laws so they know where to invest before anyone else. Think on that, that is way more criminal than a 1% hatred.. By the way I am a1%er. I did it slowly over 50 years of not over spending, not having all the toys and not incurring huge debt. I pay lots in taxes and what Biden is planning on doing to my retirement nest egg is criminal.

Biden told you all that he would raise taxes and you stupid people still voted for him. So stop crying about it and vote in the 2022 election to get rid of all the commies.

A MEN All these fokes thatvoted for that guy will ,along with each of us be paying more than when Clinton was there but that what socialism is all about !!!!!!!!

Shorty,

The only people crying about it are conservatives that didn’t vote for Biden

Half the country are us.eful idiots of the democRats . They are getting what they deserve. We the people have to suffer with the emotional Trump hating twitS.