Biden Tax Proposal a Dangerous Redistribution of Wealth

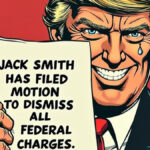

President Joe Biden’s tax proposal is a dangerous redistribution of wealth that Senator Tim Scott (R-SC) has described as “the biggest job-killing tax hikes in a generation.”

The plan includes significant tax increases for corporations and high earners. As I wrote in a previous article (click here), there is no such thing as a corporate tax hike because the added costs are passed down to employees in the form of reduced wages/benefits and to consumers in the form of increased costs.

Biden’s proposal targets the wealthiest Americans by raising the top personal income rate, increasing the capital gains tax for high earners, and forcing heirs to great fortunes to pay taxes on inherited stocks. The top 0.3% will be taxed nearly 40% on all income. To make sure high earners are following the rules, the plan provides an additional $80 billion to the IRS for audits.

“This is redistribution, assault on investment, and it makes leftwing ideology – I will say [Rep. Alexandria Ocasio-Cortez] is correct: the progressive left won Biden’s heart, absolutely,” says Larry Kudlow, an economic adviser to former President Donald Trump.

As promised, Biden’s tax hikes won’t affect Americans earning less than $400,000 per year.

“President Biden is really protecting the coastal professional class that helped elect him,” says Brian Riedl, a former aide to Senator Rob Portman (R-OH). “Those in the $200,000 to $400,000 range are going to come out ahead as winners in the redistribution from millionaires.”

All told, Biden has unveiled proposals totaling $6 trillion in new federal spending for the next decade. Goals include:

- Expanded federal safety net including nutrition assistance

- Enhanced child tax credit and compensation for caregivers

- Free preschool for kids ages 3 and 4

- Two years of free community college available to all

- Boosted Internet access nationwide

- Green energy initiatives

- Renewed focus on the training of teachers

The Biden Administration’s vision for economic growth is a stark departure from the method established by President Ronald Reagan in the 1980’s, in which lower taxes and deregulation were seen as the best path towards prosperity.

“Trickle-down economics has never worked,” Biden told lawmakers last week. “We’re going to reward work, not just wealth.”

Opponents say that increased efforts to provide federal support to low earners will end up harming everyone. Before COVID, the US economy was “the best our country has seen in decades,” says Senator Chuck Grassley (R-IA). “The quickest way to slow our post-pandemic recovery is to hike taxes.”

Biden’s plan “will not raise a penny of revenue because economy activity will slow down,” adds Robert Braglia, President of American Financial & Tax Strategies, Inc. “It is to punish the most successful, so-called fairness. In other words, to punish those who are creating the most jobs.”

Author’s Note: When you promise to give people money, they will vote for you. Of course the only way to give people money is to take it away from others. This is a socialist way of doing business and a major threat to free enterprise, which creates new paths for people to earn money themselves.

Sources:

How Biden’s taxes hit the richest but skip the suburban base

Biden’s Economic Plan Would Redistribute Trillions and Expand Government

What Advisors Think of Biden’s $1.5T Tax Plan

Biden moves to extend key parts of COVID-19 relief bills with American Families Plan

Sounds good! Wealth inequality is at historic highs.

America’s 651 billionaires have gained so much wealth during the coronavirus pandemic that they could fully pay for one-time $3,000 stimulus checks for every person in the United States and still be better off than they were before the crisis.

Conservatives seem to think of the good old days as the 1950’s.. when taxes were high and the middle class was strong. Maybe it’s not such a bad idea to go back to those days

Forty years of Reaganism and trickle-down economics have left America pockmarked with refugee camps and people hanging onto life by their fingernails

Alice,

How come nobody comments on your articles?

Alice, I have reconsidered my stance after reading your article.

I mean with the types of tax rates I was advocating for, how would Jeff Bezos afford his 500 million dollar yacht ? Or the support yacht that allows him to land his personal helicopter ? I had no idea this was the world I was pushing for.

My sincere apologies.

Still gotta wonder why no one comments on your articles?