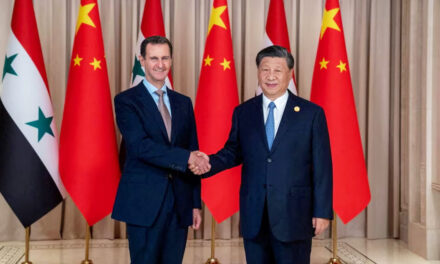

European Banks drop $56 Billion, socialist Greece poised to exit EU

European banks lost more than 50 billion Euros ($56 billion US) as Greece shut its banks and imposed capital controls to attempt to prevent the collapse of its financial system.

Stoxx 600 Banks Index fell 4.4%, its largest dip since November 2011, with all 446 members declining.

Greece triggered a sovereign debt crisis in 2009, when foreign banks had a large exposure to its badly structured economy. In 2010, to avert a wider crisis, the European Commission, European Central Bank and International Monetary Fund responded by launching a 110 billion Euro bailout fund.

Greece no longer qualifies for membership in the EU and there are widespread fears it will exit. A new bailout comes with conditions, which has been put to referendum to be voted by the Greek people. Economists speculate an exit from the EU would cause a long and deep recession for Greece, beyond what it has suffered the last five years.

While Greece is not considered a socialist country, much of the massive Greek debt has been caused by the pervasive socialist policies with high and early pensions, massive social support welfare entitilements, socialized medicine, heavy business regulation and much more.

You’re not good enough to suck Trump’s dick.

The democrats are going to throw everything they can at Trump to keep him from fulfilling his campaign promises. That’s…

And merry Christmas to all.

Yes Larry, on one point we can agree, you are a political dinosaur. You only get whipped when you lie,…

Yes, I am looking forward to Trump breaking all of his campaign promises, and the weeping of many who suddenly…