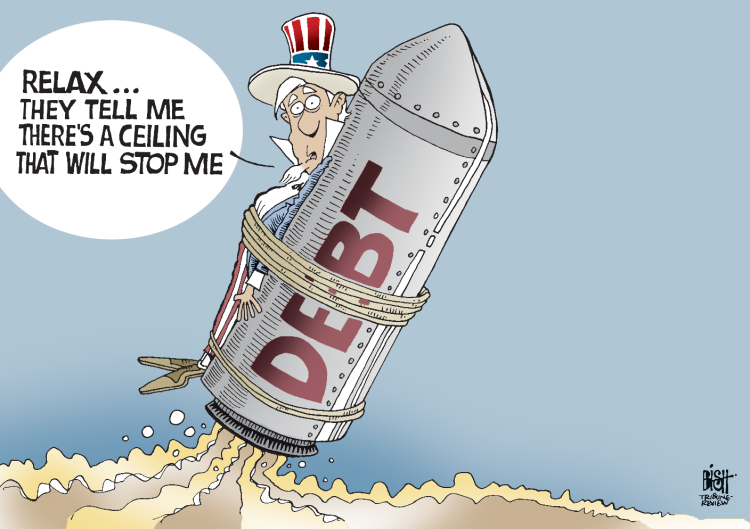

The Melodrama Over Raising the Debt Ceiling

Heeere we go again! It is time to address the debt ceiling. It establishes the amount of money Uncle Sam can borrow to pay our nation’s bills. It is extremely important that we honor of commitments. That is not debatable.

We have never defaulted in the past, so America has a very high credit rating based on potential borrowers trusting that they will not get stiffed. Our transactions are based on what is called “the good faith and credit” of the United States. People and nations buy our government bonds confident that they will be honored because they always have been in the past.

Raising the debt ceiling is not necessary because it is the ONLY option. It is necessary because we have a broken federal spending system that enables Congress to set a limit and then willy-nilly exceed it.

Of course, the folks in Washington almost always spend more money than they take in as revenues from taxes – you know, pay as you go. No. No. No. For 77 out of the past 90 years, our representatives in Congress spent MORE than they take in – a lot more. That means they must tax we the people at an enormous rate and then borrow trillions of dollars to cover the rest of their spending. So far, that has the United States carrying a debt of more than 31 trillion dollars – and it is growing, not shrinking. (Looking at it another way, every man, woman and child in America is carrying a debt of $94,000.) As of 2020, debt service (interest) we are paying each year on that debt has risen to 15 percent of all federal spending.

Once again, we are faced with the necessity of raising the debt ceiling and the political left has gone into a hyperbolic frenzy … Chicken Little-style fearmongering. The left-wing media is pounding the Republicans with Draconian analyses and predictions of what will happen if and when the debt ceiling is not raised, and the government goes into default. Millions of jobs lost … soaring interest rates … run-away inflation … or worldwide economic collapse.

Folks like MSNBC’s Joe Scarborough (and crony panelists) are hysterically claiming that as small group of right-wing extremists are about to seize control of Congress and plunge America into the worse economic crisis since the Great Depression. The left even claims that the mere effort to get cuts in the federal spending is dangerous – and could cause an economic catastrophe. That is what the folks at MSNBC are putting out. Imagine that Democrats are so committed to unbridled spending that they think the subject should not even be discussed by members of Congress.

Of course, none of that is going to happen, but Democrats and their media allies will be pumping that false narrative until the debt ceiling is raised as it always has been in the past – and most likely at the last minute, as it always has been in the past.

In the meantime, Democrats and their media cronies will be smearing the Republican Party with their false narratives. It is part of their evergreen theme that the GOP – not them – is a threat to democracy … the people… and the Republic. It is nothing less than classic authoritarian propaganda – the need to create a domestic enemy from which only they can save the nation.

But what is the reality and facts behind the debate over the debt ceiling?

Republicans want to tie the raising of the debt ceiling with cuts in government spending – cuts essential to reign in the dangerous and reckless spending that is imperiling America’s financial future. Republicans in Congress are saying, let us agree to increase the debt ceiling but lower the nation’s runaway spending at the same time.

Democrats do not want to do that. They want what they call a “clean bill” – raise the debt ceiling without any consideration to spending. That makes sense if you are a Democrat, since that is the party of unlimited tax (and borrow) and spend. That is the Party that has shown no inclination to restraining spending. They like more and more spending because they can use it to trade taxpayer money for votes through welfare, grants, subsidies, stimulus checks. Etc., etc., etc.

We have been through this debate (debacle?) before – and the outcome is always the same. The GOP is forced to fold. Democrats know that the GOP will not allow the nation to go into default – everyone knows that. So, Democrats just need to stand pat … say no to any cuts in spending …and wait for the fiscally responsible Republicans to fold.

IF (🡨 and that is a big IF), Republicans are able to secure ANY cuts in spending as part of the debt ceiling debate, that would be a HUGE move toward fiscal responsibility – and a first tiny step to get federal spending under control. But do not get your hopes up. Democrats play tough when it comes to imposing restraints on their lust for government spending. It is part of their DNA.

There are two dates to consider. Very soon, America will officially come up to the date when TECHNICALLY, the government will run out of money to pay its bills – the costs it has already incurred thanks to the reckless spending in Washington.

That does not mean instant default. There are a number of cash rich accounts that can be drawn upon to keep paying the bills until sometime in June. That is the real drop-dead day. Of course, Democrats will go ballistic – even more frenzied than now – when we reach the technical day, even though bills are still being paid for another five months. Whether the Republicans surrender quickly – or hold out for a longer period – is yet to be determined. In either case, they will eventually have to fold.

The manner in which the federal government gets money and spends money is insane. They never produce a budget as required by the Constitution. They appropriate money by a single huge omnibus budget bill that virtually no member of Congress is provided an opportunity to read and study – a bill crafted by the four Congressional leaders (with emphasis on the two majority leaders), their staffs and lobbyists.

Democrats want to do away with the debt ceiling process. They prefer to overspend and have the taxpayers pay for it WITHOUT EVEN A DEBATE. That should tell you a lot about which side of the aisle is at least attempting to bring about transparency and responsibility to federal spending – and which is not.

Congress is broken and especially dysfunctional in the arena of taxation and spending. It is a problem of too much of each – and an arcane political process that seems to make the problem unfixable.

Democrats claim that Republicans are holding the government, hostage, by not agreeing to raise the debt ceiling. I would argue that by not agree to spending cuts, Democrats are the ones holding the government hostage by refusing to negotiate spending cuts.

Do not blame the Republicans for at least trying to bring some level of fiscal responsibility to the process and to draw attention to one of the major problems – excessive spending.

So, there tis.

If someone is living off of government handouts like welfare, they should not be allowed to vote. These people will never vote for anyone that wants to put limits and restrictions on handouts, like requiring people to prove they are looking for work. Essentially, their votes have been bought and paid for by the liberal government.

Keep in mind that the more people they get to rely on government handouts to live, the more power they get and the more power they get the fewer freedoms the people will have. This is exactly how an authoritarian state is created.

Term limits along with NO life long benefits and pay will also help fix spending, once the politicians have to start living like every other American.

I am not going to blame Republicans, but I also will not view them as the party of fiscal responsibility. They spend too. Trump tax cuts come to mind? How much did that add to our serviceable debt. Weapons donations? The Military Industrial Complex is the single biggest problem in this country, it hops us from war to war. And the defense industry is the biggest social welfare program of over priced jobs and products in this world. The only difference is this: Debt is not bad if it promotes economy. There is good debt which can be paid off from increased economics. And there is bad debt which is just throwing money away into budget items that do not produce increased economics. Its that simple, and both parties do both! And then there is the third rail, Medicare, Medicaid, and Social Security. But we that are now on those programs paid for them (Medicare taxes, SS/FICA taxes) our entire lives and now all we have to show for it thanks to POTUS Johnson’s “Unified Budget of 1967” is a truckload of IOUs that both parties have written.

But having said all of this, we should not default. Both parties need to get together and determine cuts that can be made in the future. And I mean real cuts, not just cuts that cut the rate of the rate of spending. I mean cuts that bend the curve downward and gets us back into sanity. Unfortunately in our political climate, any politician worth his salt that mentions cuts will not be elected next time around. So the American people deserve what they get. They voted for it for the past 70 years and now the poop is hitting the fan, but nobody wants it to hit on their watch. Perhaps not raising the debt ceiling is the only way to stop the run away train but I think there are other ways.

1) Start with the proposal to eliminate omnibus budget bills. Adopt Ryan’s proposal for twelve bills that clearly define to Americans what we are spending on in each bill. Make it law! No riders or pet projects and political pork tucked into the deep pages of these bills. Mitch McConnell (GOP) tucked his $1.7B bridge into the omnibus bill. True transparency, not what we have now. 2) Roll back the budget and use tax revenues only to fund the budget. Stop the borrowing in the future. Roll back 2023 budget to 2022. Roll back 2024 budget to 2021 for a period of ten years. 3) Create a tax to solely go to servicing the national debt. Let people start seeing what they are paying for all of these programs as a separate tax that all must pay, including seniors and poor. All must contribute either by check or by cut to their benefits or from their benefits. Let them make the call. 4) Economic impact analysis should be attached to all bills, and only those bills that improve economy or have a zero sum effect that can be verified should be passed moving forward. 5) Get rid of lobbyists. 6) Require our government employees all the way up to the presidency (union and non union alike) to live as we do, have the same health care as we do, suffer funding cuts just as we do. Get them in touch with our reality. 7) All three rails of spending, Defense, Social, and Gov’t Infrastructure should share the spending cuts equally. Either share the cuts or raise the taxes, period! Get sanity in our spending. Bring back the WPA from 1933 and require people who collect the peoples money to do something for it! 8) Stop the fraud of our government systems like Medicare, Medicaid, etc.

Larry, you said, “I would argue that by not agree to spending cuts, Democrats are the ones holding the government hostage by refusing to negotiate spending cuts.” I would argue both parties, not just Dems, are doing this. Ask McConnell if its ok to cut his new bridge. Ask the liberals in Vermont if its ok to cut their maple syrup production subsidy! Remove all of the pork! Both parties are not just holding the government hostage, they are holding our children’s future hostage! And there is this Independent/Unaffiliated voter’s point of view.

I always chuckle at your uninformed responses, keep them coming! You already live in and have benefited by socialism. Have you ever collected unemployment benefits, been covered by a health insurance policy where others pay your costs for bad health events,ie. Humana, BCBS, United Health Care, etc. all are such policies, been to a public park or restroom, gone fishing in a public lake, gone to a state university, been to a public library, taken a federal or state owned and supported road or highway, been to an airport or taken a public bus, played on recreation department sports teams when you were a kid, gone to public K-12 schooling, had your home attached to a public water system or electrical system, been to a senior wellness or senior activity center, had a parent on Medicare or Medicaid or both – Medicaid is the largest funder of skilled facility beds, gotten a Trump check that you deposited, been helped by a public fire dept. police dept, or emergency service ambulance, = these are all examples of socialism. You live in a social system already, you have benefited from it, and now you wish to cut your nose off despite your face! Too funny!!!!

The above on paragraph response was specifically for Robin “Bobbin”. Not directed to Larry.

Larry trots out all the old Republican parables, which are just not true in today’s world.

First, about 60% of the debt occurred during Republican presidencies with about 40% during the Democrats since Reagan. That pretty much makes his entire tirade off-center.

You know in your hearts this is true. How did you expect Trump to take a giant tax cut and then deliver the worst GDP growth since Hubert Hoover and turn a profit?

Second, the debt ceiling is an artificial ploy that was first invented so that we could sell bonds without the pre-approval of Congress. It was a trick. This was 1919. Then, in 1939, they extended the definition of the debt ceiling to cover other funding issues. By 1995, the debt ceiling had a new purpose. That was to create a hostage situation, so that Republicans could basically talk about anything they wanted to using debt as a leverage. That’s where we are today. Kabuki theater.

If we abolish the debt ceiling, nothing would happen. If we default on the debt, quite a bit can happen. If we threaten to default on the debt, nothing good will happen and there’s a lot of potential bad that can happen. As Larry notes, the things that are expected to happen no one really knows. Likewise, the fact that our debt/GDP ratio has gone beyond the witching point of 100%, no one really knows when and if anything terrible will happen. We do know this: as Larry indicates, it’s based on the faith of the US dollar is a trusted investment. No one knows if we will lose that trust, but if we do, the depression, the great recession, will be nothing compared to where we will be. When the dollar is worth nothing, there are no dollars.

There’s also $3 trillion in excess bank reserves that has never been in a economy ever before. No one knows what would happen if the banks get nervous and decide to liquidate those dollars or convert them into something else. When $3 trillion of your money, supply disappears, overnight, funny things can happen. So we have now yet another investor in US dollars that may be feeling really nervous about kabuki theater. Again, we have never been here before, and no one has a clue what would happen with excess reserves. But $3 trillion should be nothing to fuck with.

The current debt is mostly held only by us, via Social Security. One thing that happens when you can’t pay your debt is there anyone over 65 won’t get their checks. They should note this the next time they go to vote. Why would you vote for anyone that would hold the debt hostage in a kabuki theater when you’re first on the block to lose your checks?

Foreign interests are the next largest holders of our debt and If they decide to invest somewhere else, it’s game over for us. Again, no one knows when and if that will happen, but when you hold your payments hostage so that you can make talking points on TV, investors tend to get nervous. We may be the best deal in town today, the safest game in town, but that could turn in a heartbeat

The bottom line, though, is no one knows any of these happenings. What will happen, when will it happen, how bad will it be? No one knows. Not the Democrats, not the Republicans, not Larry, and not I. What I do know is that when you fuck with debt, you fuck with those investing in us and if they decide to look elsewhere, we’re fucked. It’s not a work our way through this sort of this, a speedbumb, it’s a game over situation.

The bottom line is they should get rid of the debt ceiling, stop the kabuki theater, and get down to the real work of managing the nations finances using the proper budgeting process. This is not the place or manner to do this.

Why do I not see Robbin’s response.

Can you provide sources for your percentage statistics? I do not rely on my heart to know things, I like to read the facts and numbers. We Christians have all heard, “The heart is desperately wicked.” So don’t go there on the heart thing! For as much as you criticize Larry for not presenting his references for the facts, seems like you are guilty of the same.

According to the tally of US Debt by President, FDR (1028%) and Woodrow Wilson (723%) were the largest debt increases, and I am willing to cite my source as “https://www.thebalancemoney.com/us-debt-by-president-by-dollar-and-percent-3306296”. Check this out.

1995, wasn’t that a Dem administration, Clinton? So the person that did not inhale, did not have sex in his office, is also the trickster? Is that what you are saying?

I sort of agree with you that the debt ceiling is artificial and removal would mean nothing happens – that is as long as you consider having a reason to negotiate spending is nothing.

You say, “When the dollar is worth nothing, there are no dollars.” I think I disagree. You still have something since nothing is the absence of something. In this case, you have a wheel barrel of toilet paper. And that is still something. (but I digress).

Kabuki theater? Seems like a racist term (used thrice) that attempts to relate our wonderful Japanese population to something bad like debt default, AND losing social security benefits that we paid into the fund to receive. I am shocked that as a Dem you could be so insensitive to use this kind of racist expression. (but I digress again). I also think the word “tamper” would be much better to the F word (used 4 times), much more civil and polite – and we should always be civil and polite!

I do agree. We should all look at who the Dem and GOP culprits are that voted against raising the ceiling and that voted for all of these expenses and bills to pay, and vote them out. Good idea Frank. The debt ceiling rise is the effect, we need to look at the cause and vote them out!

I agree, we need to be wary of the feelings of foreign investors – but lets not weigh them too much. First tell me where they would go? China? See how that worked out for Americans who invested in 600 Chinese stock market listed companies that are now delisted and China took that wealth and put it on the HK Exchange. Or Americans who invested in US and other foreign education companies working in China when China shut down that market in a blink of an eye! Maybe Joe can destroy Ukraine/Russia and that will be the next best place to invest as Germany was in 1918-1928? That is until the Germans could not pay it back. We will still be the best even if we stumble a little. But we better not stumble often, and we better fix the cause of our stumbling. Which seems to be ever expanding social programs and the Industrial Military Complex. And by the way, most of our debt is owned by us.

I do agree with your final statement even though you presented it once again using a racist term, or in a racist manner. And proper management starts with prudent decisions on the use of money, good debt versus bad debt, transparent budgets with no pork, etc. And it should all be encased in law.

Tom, if Joe will change his website, so that it did not hold threads that use links, I would source the living hell out of everything. Not my fault, it’s a system problem.

Jfgi: who spends more, Republicans, or Democrats. You’ll find plenty of sources.

jfgi: standard meaning for political term of kabuki theater. I can find no references to racism or the fact that Japanese consider it to be racist. You are not Japanese.

I clearly noted that the debtI was talking about started with Reagan. Why, Reagan? After World War II and the incredible deaths you have mentioned, it took 35 years to bring her down to a reasonable level. That year was Reagan, and the debt has been increasing ever cents, as Larry noted, under either party. we could catch a glimmer of blue sky during Clinton, but even he did not pay down the debt with the blue sky.

As I have often noted in the past, after those large debt increases, we worked on the debt for 35 years. That was the greatest generation. Since Reagan, we suck.

Sorry about the F bombs, but I get a little vexed when these Republicans start spewing about tax and spend Democrats when historically the exact opposite has been true since Reagan.

FYI: yes, it was Clinton in 1995 and it was the republican party that held the nation hostage using the debt ceiling. Remember Gingrich? Thanks to Clifton. No one else does… Man I miss that guy.

Somehow, I find your “there’s nowhere else to go“ theory of investment to not be consoling. One place they could invest is at home. In any event, the goal is to be in a strong financial position with a sound foundation, and a stable future of sustainable growth. Using the debt ceiling as a battering ram is not that, and consoling yourself that people can only invest here is a fools vision.

The U.S. government barrows counterfeit money from private international bankers who really had no money to loan.

Why doesnt the U.S. government just issue this counterfeit money directly and bypass these private bankers and thereby end up owing no interest on the “debt” and also not be liable to pay it back. This would result in the same inflation we have now but at a lower rate.

Larry, why is it that we never have these arguments over the debt ceiling when we have a Republican President? We certainly have massive spending under them that add to the overall debt and yearly deficit. And why is it that we never discuss increasing taxes? The last tax decrease by republicans resulted in a big fat goose egg in economic stimulus and dramatically increased the deficit. Increasing taxes seems a very simple way to resolve the situation. Somehow you seem to be an expert at pointing fingers at everyone on this topic, except the true culprits. You also prefer to ignore the solution that could reduce the deficit to zero and solve the problem once and for all (recall who was President the last time our deficit went to zero, and then who made deficits come back?). Just saying, as usual you are blind to the facts and spin your yarns to paint the drms in a nasty light..

Mike f …. You do not recall the debated over the debt ceiling when we have Republican presidents. You just do not know the history. Conservatives always try to reign in spending Also, you need to understand that Congress — and especially the House — has more to say about budgeting and spending than any other portion of government. President do not create budgets or set the taxes and spending. With that in mind, the time you refer to — where the deficit was zero — was when Republicans took control of the House. Clinton signed off on the work of Congress. Clinton was arguably the most conservative Democrat President since Kennedy.

Larry, You make statements, but then don’t document those statements. When exactly did we have a debt ceiling issue when a Republican was President? And you certainly ignored the real solution to the debt ceiling-raise income taxes (not replacing income taxes with some asinine sales tax farce). And, since republicans are so fiscally responsible-why didn’t the deficit remain zero when W entered office? The bottom line is-republicans talk a good story when democrats hold the WH, but when they have power, all bets are off, and who cares about deficits or the debt. Face the facts-your party is two-faced…

Actually Mike F, I think the answer you seek is very simple, and only requires a “Spock” saying, “The answer is simple logic Captain”. When Republicans are POTUS they can raise the debt ceiling with little to no complaint because 1) they view their debt increases as good for America, i.e. Trump tax cuts; and 2) They are dealing with an opposition that has little to no opposition to raising the debt ceiling, thus no need for arguments.

There Captain, simple logic!

Mike f … you call the sales tax concept and asinine farce even though it is legitimately and successfully used by government all over America. It is arguably the fairest and most efficient tax method of all. That makes your response both snarky and stupid.

yes, it is used but debatable as to 1) it works and 2) it’s fair. More so on the later.

I have seen no proof to contradict that. Not here at least. Lots of hype though.

Gotta love a Republican taking credit for Clinton.

Suddenly the buck stops somewhere else.

Yes, Congress manages the budget; the President is supposed to submit a budget.

However, the President has veto power over Congress via the line item veto act signed by Clinton. . History is a fickle bitch.

Nobody would ever want to be associated with the rapist. Except democrats

I like the line item veto. Problem is the budget omnibus package is over 2500 pages and one would have to spend their full term with red or yellow highlighter in their hand.

Let’s face it, the omnibus process is not a good way to manage a budget NOR the preferred manner for Congress to do it. It’s a workaround, a punt, against the fact they can’t create a budget, haven’t for decades.

Clothes maketh the man and process makes a plan. They have no valid process, they have no plan. The line item is good IF you have a budget.

It’s the only way Republicans can get the attention of MSM.

FOX told them it makes great TV.

Isn’t that how you control spending? Just stop paying bills?

Whenever I can’t pay my mortgage, I just kidnap the neighbors kid and tell everyone about the harm I will do if they don’t create a balanced checkbook and pay down their mortgages and investigate Hunter. Or else!

Turns out that if you raise the debt ceiling, your bills go up, the amount changes It’s magic. Maybe we should lower the debt ceiling to lower our bills. Let’s try that.

Sorry, they hit my Republican ceiling…..

.

Frank, if you use the ” ” and put the link inbetween like I do, it will not appear as a link but a person can copy and paste it into their browser. Seems to work for me. Notice I did it where I referenced my source. I do not need to do anymore googling, I referenced a list of all presidents back to 1900’s and what their national debt contribution was for their administration. Democrats/Progressives claim the top spots in our national debt history. Lately, it seems like Republicans, but I’d rather look at the data than sense of feeling.

My objection to your use of the word “kabuki” is that the word is used and defined as “Japanese drama”. All you need to do is go to a dictionary. It won’t say that it is a racist term. What I said was you were using it in a racist way. Why didn’t you call it faggot drama and insult LGBTQ. Or maybe call it Negro drama? Or maybe call it Jewish drama by calling it “Meshugener Theater”? Why did you pick a word that is so easily recognized as Japanese? Why not just be neutral and call it song and dance political drama – since that is what Kabuki is and what you meant. So by using a clearly Japanese word, you singled out their race (definition of racism) attached something positive and nice from their culture to an American problem garnished with negativity and stupidity, and you do not think that is racist? I’m shocked but not surprised – I must be just a little more righteously woke than you brother.

I scanned your response again but could not find “Reagan” but if that is at least what you intended (wasn’t Reagan 1980-1988) I can agree. Post Reagan politicians seem to think they have a limitless credit card that they do not need to pay off. I have read plenty of articles that state some countries are very worried about our spending. So we agree here.

Just a casual observation: Since Post Reagan, every president has had at least one war to deal with. I am wondering if some of the root cause might be our CIA and our Military Industrial Complex – both seem to be always needing wars. Eisenhower actually warned us against the Military Industrial Complex in a speech you can find on Youtube. Your thoughts?

Yes, I do remember Newt Gingrich very well, and his “Contract With America” program. Newt brags to this day how well he and Clinton got along. ARe you saying you miss Newt? Or Clinton? Personally, I liked both.

Yeah I do not mean nowhere else to go for a long term strategy, I agree it is a fools vision. And it is reality. Both at the same time but sooner or later something will give and there will be another place to go. I much prefer us paying down debt, being rock solid financially, and viewed as the “best place to go” rather than the “only place to go”. The word “only” implies the investor does not have a choice at the current time. “Best” implies quality management principles in handling our finances and debt, which I am very for.

Enjoyed your post Frank. Your a stand up guy!

Tom, thanks for the link-tip.

If you didn’t want to google, why ask for a source? Whatever you found is good, I have seen too. BUT — since Reagan, the debt has been 60/40 Repub/Dem. Why since Reagan? As I noted, the debt was over 100% of GDP after WWII and it took 35 years to bring down to a reasonable level, considered about 30%,before all we did was go up. The pivot point was Reagan so that’s where we start.

The MODERN DEBT, the CURRENT DEBT really starts with Reagan and not Washington. So if you start where our current debt starts, it’s Reagan.

“In nominal dollars, since World War II, just over 60% of the growth in the debt took place under Republican presidents, and about 40% under Democratic presidents.” “https://www.statesman.com/story/news/politics/2021/09/28/fact-check-democrats-blame-expanding-national-debt/5891161001/” The google search turns up many confirming sources, most use the same metric of post WWII or Reagan and many have much larger ranges between dems and repubs. Again, your data is correct.

And my only point in all this was that the very foundation of all of Larry’s arguments are built on that old trope of tax and spend Democrats. Freakin Biden has actually tightened the debt leash from the Trump tragedy and Larry still says tax and spend….. He knows the truth in his heart and he can see it on the chart, but he still denies and we all know that denial is just a river in Egypt.

Actually, I could care less how much debt we hold; I am interested in how much debt we can support and, more important, how we spend our debt dollars. IOW, if, and it’s a mythical IF, if I can get people to loan me money at interest rates that I can beat with my investments, I will take those loans all day long. I took thousands in penalties this year to make thousands more over the next 12 months. Breakeven in less than a quarter. Not a problem with that loan. Similarly, if I need money, like to do things I want to do, and people can let me use theirs at a reasonable rate, why wait? Why not borrow? As you know, you can borrow right up to your collateral. In the case of sovereign nations, the debt/gdp ratio is a physical measure of collateral except no one really knows where the top end might be, and that the top end will be a different factor for each nation, frankly based on feelings. Kind of like two guys, France and Spain, both with the same collateral but France is black and is offered a lower loan. Who knows the exact factoring of how much can you borrow? Feelings.

And better yet, if that Chinese guy wants to take my greenbacks and give me a nice sweater, why not give him pieces of paper for a nice warm garment. I can wear that sweater everywhere, all the time, and all he can do is ultimately redeem that paper over here, for my stuff, that I plan to rip him off for. Or, if my style is good, he can redeem them other places, but ultimately, that buck stops here. Pretty nice sweater in trade for paper.

But IMO, 100% debt/GDP gives me a really bad feeling. I got a bad feeling about this and worse yet, if it happens, it will be in an instant, no warning beyond what we already know today.

Culturally, we have said 100% debt/gdp is the top end, great economists have blessed it, it’s the WWII benchmark of ouch, and we pierced that with Obama and blew it away with Trump. It’s a estimate of the measure of the point that people will no longer invest with us and the one that has me totally freaked since Obama. The problem is 1) no one really knows the top end and obviously 100% is not it for the US and 2) when you do reach it, it’s not a gradual problem, it’s just all over — think Greece without other nations to help. Unlike Greece, no one can help us, the pain of being number 1 and far and away bigger than almost anyone else.

Greece cleared 200% and poof, no more money as the shit hit the fan. “https://www.thebalancemoney.com/national-debt-by-year-compared-to-gdp-and-major-events-3306287” I will let you further research the meaning of the ratio. FYI: the “in your hearts” thing was trying to indicate that you really didn’t need fancy math to see that no GDP growth (ie tax growth) combined with far lower receipts (ie lower incoming taxes) cannot be a positive debt picture. You really didn’t even NEED to see a number.

Kabuki theatre: ok, I get it. As usual, I apologize to our Japanese friends and will remove my lexicon. Damn Andera Mitchell made me do it :>) You are right. I looked it up. Can I still eat my Danish? (Although I did like how you added all those other insults under the guise of a teachable moment only to lose your “most woke” award by spewing a litany of terms not to be used :>)

Yes, we agree it’s both parties, neither can establish a budget, much less manage it, and the omnibus bill is a big word for clusterfuckfinance. And the problem is Congress, period. There’s lots of puts n takes from the complex to the NWO to progressives to trumpists, but only Congress owns the responsibility and the process, of which they are not even perfectly adequate or up to the task.

I miss Clinton, loved to watch him work. They never tagged him and better yet, he royally did in anyone who tried. Star went super nova, Gingrich slinked away, it was over and over. Loved it, have never seen it matched even by Pelosi.

As to what to do: another time but it starts with having some balls and doing your job: Congress. It’s a main reason you were elected. You need not only a budget, but a process that works. Budgeting, appropriations, and financial committees that actual produce a reasonable budget. You need to act like a business, set some benchmarks for success, manage to them, measuring results and making corrections for misses. Trump did a stupid mandate for legislation saying he would remove two for every one added. I hate these mandates that absolve people from doing their jobs but Congress is clearly unable to do their budgeting job, so maybe we even need some of those kinds of mandates, short-term, to get our house in order. Sure beats hunting down Hunter. Likewise, a Constitutional balanced budget just lets Congress off the hook. I would never run my house like that, I find it incredible that the States do it, and can’t imagine a war breaking out and The President saying, sorry, we’re tapped out…… Sovereign nations are not houses…. But even there, given the malfeasance of Congress, I could see setting some short term budget caps with metrics for early dismissal to get us on the right path.

The bottom line is Congress needs to do their job starting with creating a budget. Twenty years of a budget replaced by appropriations and omnibus bills is malfeasance. Arguing the debt ceiling will not solve that, it is just another diversion from Congressional responsibility to, well, you know what I want to say. But I woke and I won’t.

(funny story: I am the ugly American, and once walking the street of Tokyo with my uptight corporate types, I kept speaking in a terrible US-Japanese accent “where is Godzilla, hero of Japanese people” to the complete shock of my compatriots. We’re walking all over the place looking for a spot to eat. Finally, after hours of this, we’re coming home, I am still mouthing of, when, in the middle of Tokyo proper, we come on a quarter block park of cement flower boxes, fountains, statues, and such. Very unusual to have open space in this part of Tokyo. And there, in the back corner, up like five stairs, is a cement platform at eye level, with a two foot pedestal upon which sat a three foot Godzilla, hero of the Japanese people. My ugliness wasn’t redeemed, but at least my compatriots were impressed.)

Tom … I disagree on you making an analogy of Kabuki Theater is racist. The style of the “theater” can be seen as a reference to certain political or other situations. The analogy is the the style of the theater, not the culture. Would you oppose the use of Balkanization as a slur on the Balkans? What about the word “vandalism.” I guess there are not enough Vandal to complain. Is it ok to insult circus workers by calling something a “three ring circus.” I see your point, but I think you are demonstrating the evil of political correctness and identity politics.

There’s enough feeling blue about the use that it’s just easier to replace IMO. After all, circus, clowns, probably more appropriate to the McCarthy club anyways.

Yes we will have to agree to disagree on this one. I see your point because you learned the term long ago from prior generation that fought the Japanese. Now it is time to relearn and undo the old learning, and evolve.

Kabuki is a classical form of Japanese dance-drama. Kabuki theatre is known for its heavily-stylised performances, the often-glamorous costumes worn by performers, and for the elaborate kumadori make-up worn by some of its performers. The term kabuki originally suggested the unorthodox and shocking character of this art form. In modern Japanese, the word is written with three characters: ka, signifying “song”; bu, “dance”; and ki, “skill.” which is opposite of the way it is used by you politicians! Your analogy is way off when you say, ” The analogy is the the style of the theater, not the culture. Kabuki is part of their culture!!! You are using an old and obsolete analogy that no longer applies (and never did actually apply to American politics) when you say this. Kabuki theater performers are very highly skilled, highly trained, and have years of practice behind them.

Now, more recently, 9Post WWII) Kabuki has entered general English as a synonym for theatrical. In the US, it is often used to describe politicians suspected of acting insincerely to please their supporters and/or attract maximum media attention, or as a “performance style with no substance”.

They deploy Kabuki because:

1) It sounds funny.

2) It sounds childish.

3) It sounds foreign.

4) It sounds incomprehensible.

Kabuki succeeds chiefly because it makes your opponent sound silly and un-American. And finally kabuki works because:

5) It sounds Japanese.

I am not trying to be PC. I have for years tried to rid my use of language / terms that are insulting to race, gender, creed. Kabuki is one of them that we learned from “the greatest generation” but you do not seem to acknowledge when the term’s meaning changed – which was after WWII. Many of us learned the modern political definition of Kabuki from our parents who fought the Japanese, and hated them till their death. Kabuki which is a highly skilled Japanese cultural art form became a derogatory word used by politicians and anyone wanting to speak poorly about something. Perhaps you need to consider this:

How would Larry feel if his favorite art form, ballet, or maybe his last name itself, say, became another nation’s derogatory epithet? How many Americans today steer clear of actual Kabuki (it is regularly performed here) because of the word’s reputation? Would Larry be happy if it became common to say “I just went to the bathroom and took a Horist?” Or maybe something milder like in the old western called Lone Ranger where nobody knew that the meaning of Tonto is Spanish for “silly, stupid, and foolish”, yes that show called American Indians silly stupid and foolish, and we never knew it! Maybe we start using Larry’s last name to mean conniving, scheming, untrustworthy bastard as we sim[ply say without thinking, “Don’t you go Horist on me!” You know, similar to how Supreme Court Nominee Robert H. Bork was excoriated by Dems, and his name is now synonymous with “being borked”! I am sure you know this term!

Please educated yourself with this article: “https://rickontheater.blogspot.com/2011/09/its-time-to-retire-kabuki-word-doesnt.html”

I did not say Kabuki was a racist word. What I said was that the term was being used in a racist way because it targets by language, a specific race and assigns a derogatory meaning to that word, thus also to the language/culture/race that the word comes from.

Evolve on this one Larry! I will help you!

It’s simple. Called being polite. If it offends, you should bend. Does it really matter why? It’s that simple.

I even dropped my WV jokes because regional slander is just that. And if I have to work harder and be more creative to be funny, so be it.

I appreciate Tom pointing this out.

Once my FIL from Genoa told an off color joke about cheapness tween the Jew and the Genovese. The Genovese, known to be tight, took the hit. Worst joke ever but he’s born in 1912 so let it slide. Later told it to clients from Belgium who rolled on the floor laughing. This shit is global and timeless unless the buck stops here.

One of the things I notice about my kids who are born in the 90s is they have none of that stuff we grew up with growing up in the ethnic neighborhoods. The concept of all the different slang names for all the different nationalities just really didn’t exist for them. their attitude towards different races, and people were quite different just because of the way they grew up a few generations from mine. You can learn a lot from your kids, no one is born with an affinity for humor based on stereotype. It’s learned and can be unlearned by teachable moments like Tom’s. .

Thank you Frank. I promise you that I have had much relearning to do as well as my fair share of teachable moments. But I can honestly say in the end its worth it.

Frank, I enjoyed your comments as usual! Great job!

First, thank you for seeing my point on the Kabuki comment. I appreciate your reflectiveness on the matter. Perhaps I may have lost some of my woke veneer, I will go back into sensitivity training. HOWEVER!!!! I did think it ingenious how you managed to tuck the f-bomb into at least once statement, “clusterfuckfinance”. Very good! I know old habits are hard to break. LOL 🙂 Please have a Danish on me!

Actually now that you have clearly contained your debt limit spending comments to Reagan and forward, yes, I agree with you. And yes, I have noticed the Biden WH as saying they are actually lowering debt. I will check out the reference you so graciously provided. Republicans do seem to be in this mode of decreasing taxes which gains votes, but then they pass it all off to debt which nobody sees. Not good, and I am against it. We should not be having tax cuts while we increase debt. Not good. Lets pay the debt off first so our posterity will remember us for something good and not pee on our headstones for what we really passed to them!

Yes I read your article at “https://www.thebalancemoney.com/national-debt-by-year-compared-to-gdp-and-major-events-3306287” on national debt. I agree with the article as you do. Yes the table is very concerning and does show an upward trend since 1988, Reagan’s last year. And like you, I am very concerned about it all. And I agree with your analysis of congress not doing their job and letting them off of the hook with a “balanced budget”. It was not long ago, maybe a year or two ago, Sen. Manchin stated our national debt was too high and his concern is that if we got into a war, we would not be able to afford it! His statements to me were like the old firebell in the middle of the night when everyone would put on their long johns and come out with their buckets! But his statement went largely ignored. Fact is, I wish Manchin would run for POTUS. I think he is pretty sensible! And I appreciate the woke restraint you showed in the latter second paragraph of your debt discussion. Yes I agree, especially these darn omnibus bills – they are a disaster that we the people should never let happen. Sensible budget and money management that leads to sensible appropriations is the way to go. And we must pay that debt down.

Great Tokyo story! Was this the statue? “https://www.nippon.com/en/ncommon/contents/behind/54888/54888.jpg”

Thanks for the debt articles and education. I appreciate it.

I’ve been Rocky-ed…..right park, wrong statue, mine was much smaller, is in Hibiya Cinema’s having been moved.

“The original Godzilla bronze statue, which was built in 1995, was removed from the Toho Plaza in Hibiya in 2017, but it has returned. The Godzilla statue is now on display in the new Toho Cinemas Hibiya, a theater complex which opened on the 4th floor of the Tokyo Midtown Hibiya building on March 29th. The building is located at the front of the plaza, which was recently renamed “Godzilla Square Hibiya”. Now, fans are able to see both the original one and the new Shin Godzilla statue at Hibiya. The cherry blossoms in Hibiya are now blooming for Tokusatsu fans…”

The park is much bigger, must have been the food, drink, and darkness so just caught the corner. The Imperial was some hotel too, kind of like the Plaza in NYC —- old n venerable, some people just say old now.

Tom, One last wild card since you seem to like this stuff. Do you understand Excess Bank Reserves and how they factor into our economy, much less affect on debt, inflation, etc? Cuz I don’t, and would love to even have a guess.

Excess Bank Reserves: the great unknown wild card.

What are they? It used to be that we-the-people did not pay interest on excess bank reserves and therefore the banks did not have any. These are not the dollars the bank “rests” with Treasury to fulfil it’s 10% holding rate; these are truly excess dollars that the bank can hold at the Treasury or Fed instead of lending or investing elsewhere. With Bush Jr, they invented the ability to pay interest on said non-existent excess funds but never implemented until, voila, The Great Recession and The Great, now Mini, $3T Obama Stimulus when they were implemented as a way to limit inflation due to all that free money. Guess where the entire stimulus basically ended up? Something that was non-existent became a $3T fund by the time o Trump, went to 4T last year, and instead of inflation, we pay interest so the banks don;t have to invest, now around $7B a year. The interest is a paltry .15% but the banks have no cost, no infrastructure, to do it. And do it they do. But we kinda do and kinda dont’ pay interest since the Treasury basically takes it out of “profits” which it just doesn’t give us back, sounds like a hidden tax and back-o-barn financing to me….

No one really knows the effect of this, nor do they know where this money is trending, up or down, in or out. It never existed before Obama and now it’s HUGE. I mean 3T can have a noticeable effect on our economy.

Foreign holdings of US Debt about 7.5T. You can see that 3-4T is a big number especially when the banks could literally put in out for loan overnight. Should get us half as excited as we do about dem furners owning us? I just know that when Obama got the stimulus going, I dumped everything getting ready for inflation and increased rates on fixed assets. And I waited. And waited…. Nothing. Then I learned about the new interest being paid and wanted to take my vote back :>) Thank God for competition, Wachovia getting crazy in expansion, and I could dump it all there right before the crash and their bankruptcy/merger. Phew, better lucky than good I always say. But I still don’t understand the effects of excess reserves, pretty sure no one does.

No one ever assessed this fund, no one knows where it is going, up, down, in or out OR why it moves or would move. It is a new concept in our economy, it is HUGE, and we just pretend it’s not there. Imagine if the banks had fire-sales loans and the entire $3T hit the money supply. I think Trump did $3T, Biden $2T, and we see the effect. Imagine another $3T hitting the money supply now.

It’s big stuff and no one knows how it will effect the economy. They don’t even know what makes it move. Scary stuff which is on top of the stuff we’ve been talking about because we just don’t know what moves it and if it moves, what happens. Never seen it, never felt it, never been there before.

Let me know what you learn :>)

No Frank, I do not know anything about excess bank reserves. Years ago I did hear a concept about leveling the economy by pulling money out of it when the economy is good, and holding it for release when we have a recession. Effectively it puts stimulus back into the economy at a planned rate that will help avoid inflation due to recession. Thus we get out of recessions quicker because we do not go so deeply into them. But I never knew how they were planning on pulling money out of the economy, higher taxation was mentioned – but it seemed like the idea faded away. And I always wondered where does one put that huge amount of money that they are going to park. Maybe government buying its own bonds or something? But what you are describing sound a bit like what I heard back then and am poorly describing here. I do not know but I will check into it tomorrow and see what I can find out.

Frank, read this. It sounds like what you are describing, and, works the way I am describing. Its a monetary tool created by the fed. See this info at “https://corporatefinanceinstitute.com/resources/economics/excess-reserves/” This sounds like exactly what the fed is doing right now. Raising rates so as to incentivize commercial banks to take on more money from the fed (since 2008 banks get paid interest on their excess reserves). This takes money out of the economy and holds it distributed among all of the commercial banks. The effect is to stabilize the economy. Then when a recession occurs, the fed lowers interest rates which incentivizes commercial banks to release some of their excess reserves as loans which essentially puts money back into the economy. So excess cash reserves is a tool whereby money is held by commercial banks so that the fed can better and more quickly stabilize the economy by raising and lowering interest rates. This tool started in 2009 as a response to the crash.

Thanks Tom and wow —- apparently through time and a bad search choice by me, there’s a world of commentary out there right now.

You are, right, it is a tool basically designed to suck cash out of the money supply being paid for by “profits” so a stealth tax payment that few notice. What’s $7B tween tax accountants?

However, as you note, what God giveth, he can take away. Therefore the fund also has the power to flood the money supply.

The risk? Well, it sucked the inflation dollars from the Obama stimulus out of the system as well as most of the Trump stimulus, but got caught during Biden to which I contend was a combination of three things: Trump/Biden late 2021/2022 stimuli combined with US savings increases. US savings rate and total value began it’s second plumet in March of 2021 as the summer of covid was upon us, mission accomplished? Add an imbalance of oil supply/demand, a war with a major supplier, and we are off to the inflation races.

But the US did suffer less than others, I wonder what they do in this regard.

FYI: I think you can slip a single link past the gate, it’s multiples that get you. You know, size matters to Joe :>)

The good side of this I guess is the Fed has one more tool to adjust money supply. Again, it’s a terrible arms-length tool to control money supply via interest on loans essentially. Plus, the down side is here’s another place the Fed can fuck up in the control of the money supply. And not many watch both interest rates much less assess effect. All it means to me is when the Gov or Fed hits the stimulus money, I am not going to dump all the equities and prepare for fixed assets. There’s a new governor on the system. The last time I did this was EOY2021 and it took to 3rdQ to get livable rates on fixed assets. I could have waited one or two quarters. Still don’t have a clue on how much rate it takes to affect excess reserves but thanks to you, I get the process now.

Yes I agree with you Frank. I never quite looked at it that way but you are right, its sort of a liquid stealth tax. I think another thing that affected Biden was that during 2021-2022, many people made the decision to pay down debt with that free money. Others who were renters, once they were guaranteed they could not be kicked out for lack of payment, they turned their efforts to paying down debt as well. This all put a huge amount of money into the money supply during a short period of time. Normally that period of time to pay down debt would have been longer if they were just paying out of W2 wages so money would have trickled into the supply, not gushed as it did. So with the shorter time to pay off debt, we begin to see how a massive paying down of debt to quickly can actually hurt this tool in that it gushes money into the supply as excess cash! Which then according to the tool, triggers higher prime rates to pull money out, which incentivizes banks to hold excess cash because they get paid interest on it which is higher than making commercial loans, which ultimately drives up business expenses and cost of goods – which drives inflation and cools the economy. And then as Kamala sings, “The wheels on the bus go round and round” the cycle restores and repeats.

I recently cashed in some oil stocks and purchased three different bank stocks because of this cycle. If inflation continues and fed raises rates again, the economy will cool down more and banks will have incentive to hold cash because they get paid interest by the fed to hold it which makes them more profitable, businesses in order to stay afloat will have incentive to borrow at the higher rate in order to sell goods like cars where they strike deals with banks to offer better financing options, and some of that bank profit flows to investors.

Well, I hope you sold your oil stocks at a profit and if this works out for you. It should. In the first quarter of 20 22, expecting Covid was over and spending would go wild, I invested in couple of inflation fighters for restaurants And another for commodities. Neither have turned out that well… Thank God I stopped. I did pick up some heavy dividend stocks, they too, are tanking, but the dividends keep rolling and they are much higher than fixed assets.

I am not sure, but I think that excess bank reserves are not included in the money supply, and if they are, they are most certainly not part of the magic money expansion where a dollar in the bank equals about ten in the supply.

You are definitely correct in paying off debt reduces the money supply whether you pay it off early or on time, same affect. Your point that it all happened at once. It’s probably quite accurate.

I hear you on the rest, but it makes my head hurt. For the life of me, on a practical basis, I cannot see why anyone would want to hold money at these low rates even if risk free. It’s just hard to believe that Bob, the loan manager, is that much higher cost and risk. One thing is certain, excess reserves makes the whole economy much more complex. And as I have always said: complexity equals greater profit for me! That’s why windows and iPhones are proprietary!

Yes Frank, I think you are right. It appears that excess cash reserves are a requirement of Dodd-Frank subsequent to the 2009 crash, and are not part of the money supply. I think that’s why they call it reserves, because it has effectively been pulled out of the money supply to be held by the bank. The interesting thing is that from what I am reading, banks get paid by the fed to hold this money in reserve. What I think is most important is to figure out how to monitor this at the investor level. Banks will start taking on more excess cash reserves when the fed is planning to hike interest rates because the incentive is that they are going to be paid by the fed to hold those reserves as the economy slows, and it is an indicator to us that the fed is planning to cool the economy. Then as the fed plans to stimulate the economy, it lowers interest rates which disincentivizes the banks to hold the reserves and the cash is released into the economy. My gut feeling is that banks hold more excess cash reserves slightly in advance of the fed hiking interest rates – but this is a gut feeling hypothesis that I will investigate and test. How it affects us is that if we get caught buying the wrong kind of stocks during the pendulum swing from hot economy / low excess cash reserves to cool economy / high cash reserves, (and visa-versa) the stocks we buy may be low performing during that part of the swing which could last up to 12-18 months of holding a loser stock until the pendulum swings back the other way once the fed has achieved its goals.

I think the interesting thing about all of this is that politicians have devised a way to manipulate/sure up the economy while insulate themselves from economic swings – just blame it on the fed, not our elected officials. Its their tool, not my tool kind of things from the political perspective. And the fed chief is an un-elected position and body that probably has as much if not more influence on our lives as the elected body that we all spend our time debating over. And yes, sneaky form of financial manipulation that acts as a liquid stealth tax. Two weeks or so ago, Janet Yellen said that the fed has never collected as much revenues as it is doing now. So the tool is good for the fed, not necessarily for us. I prefer raising taxes (as opposed to a sneaky tool that we do not see) during high economies and putting that money in reserve so that in low economies the government can release the money to stimulate the economy without impacting the national debt. At least then we can see our taxes.

Two things I am going to do now that I understand what they have done. 1) Examine each of my stocks to determine which side of the swing (low excess cash reserves or high excess cash reserves as indicated by the prime rate and anything I can find on how to monitor excess cash reserves) the stock performs better at. Is it a recession proof stock that performs better with a tight money supply (high excess cash reserves)? Or does it perform better with a hot economy loose money supply (low excess cash reserves). And then I will arrange my portfolio better to balance it so that I can take advantage of swings both way. 2) I am going to pose these questions to my brother who is a big private investor and runs and investor club and ask him what he knows about it. IF we can connect somehow outside of this blog, I will share my results and discuss further with you. Are you on facebook by chance?

Yes, I did well on the oil stocks. Do you remember about ten years ago when the stock market had that sudden dip that lasted about ten minutes or so? I saw the dip, it was about 25%. The SEC never fessed up to what actually caused the dip. I suspect it was many computers of big investors selling stocks at the same time, and Chevron dipped 25% for about 10 minutes then climbed back up. I noticed the dip only because I was online buying that day. I was hesitant but rolled the dice and bought a bunch. I was a bit scared that it might have been an attack on the markets and possibly my funds would get tied up in the attack but I rolled the dice anyway. Turns out I got all of that stock cheap. Held it ever since because dividends were very good. Then I sold it this past week for 2.7 times my purchase price – and the icing on the cake is that it was all free trades! Ya gotta love that!!!

I’m not sure when Dodd frank was, but this thing was passed under bush Junior, and implemented under Obama. After reading your passages, I believe the entire intent was just another governor on inflation in the economy.

For the most part, it’s worked swimmingly. And I cannot say this last inflation surge could’ve been fixed by this, or was broken by this. That’s a good question. But as an investor, I probably will not worry about it too much.

To check it, it’s simply a matter of looking it up online, the Fed reports quarterly.

My only fear is that something stupid happens. Although, I don’t have a problem with that management, especially given that they’ve managed well lately. Yellen, that’s another story.

But I should check what happened in this last inflation surge. Economics is always best in hindsight, especially since we don’t have a freaking clue what’s going to happen next

My number one economic adage: wherever you are in the economy, you have never been there before. So you can use history as a potential guide, but never as the rule. For example, there is not enough history on these excess reserves to even hazard a guess of how the economy will react. .

I hesitate to talk off-line about finance. I always feel that people listen to me. I do not like the responsibility. Nor do I Facebook, or any other form of social media. Too old to learn new skills in that regard. My wife translates Facebook for me…

But, I’m more than willing to talk off-line in general, just not in the area of advice and recommendations.

I bought a pile of Exxon when it was in deep kimchee. And everyone said don’t touch this company. But I am contrary and so I bought a pile. But I exercise a pretty tight control of the profits, and therefore set a trailing loss limit at about 10%. The stock began to fluctuate wildly, and so I was automatically forced to cash in at 15% profit which is good enough for me. Think the frickin of dividends for a 10% at one point but I had less than 6 months so good profit.

Lately, I have moved to tax and non-tax accounts, putting all my profits in non-tax accounts, and basically buy muni’s in my tax accounts. I’ve also been extremely heavy into fixed assets as of second haft 22 or just when the rates went over 4%. figured I’d sit back for a while. Gives me more time to post here, ain’t everyone happy? 😉

Do you know that Trump in four years ran up 25% of our current national debt.

And these Republicans want to burn the house down instead of paying their bills to gain leverage? What happened for the last four years?

These people should not manage a piggy bank, much less the nations finances. I’m not sure there’s one of them we can add 2+2.

Yes, Trump was bad for national debt. Those tax cuts all went to debt to pay for them. Pissed me off. Sneaky way of getting votes and billing our children for it all. It infuriated me!

What the GOP is doing right now, to me, is very stupid. Paying bills for services rendered is different from curbing spending. Its like having a credit card and the credit card company calling you to tell you that they will not pay for any of your purchases until you show them a plan that says you won’t use their card so much. Stupid!! Dems are correct on this one. GOP will have a budget cycle where they can actually make a plan and cut spending and do what Dr. Rand Paul suggests by making omnibus illegal and doing twelve separate and distinct bills to cover funding and tie those bills to an actual line item budget. That way they can approve some and haggle over others, and not sink the ship – maybe just temporarily flood a few water tight compartments.

I agree, IQ tests should be a requirement to run for elected positions. I think this is the problem that exists when a speaker makes backroom deals to get elected and does not make publicly known what those deals are that he cut. I hope he can find some moderate Dems to work with. At least then it gets communication across the aisle.