China and Russia’s Push to Reshape Trade and Payment Systems to Exclude the Dollar

China and Russia are spearheading efforts to create a new financial order that could shift the balance of economic power away from the West. Both countries have found common ground in challenging the dominance of the U.S. dollar, primarily through the BRICS coalition (Brazil, Russia, India, China, and South Africa) and its recent expansion. These moves are part of a larger strategy aimed at developing an alternative payment and trade system that bypasses Western oversight and sanctions.

Why Are China and Russia Leading This Charge?

Russia, heavily sanctioned by the West following its 2022 invasion of Ukraine, has faced significant challenges in maintaining economic stability. Many of these sanctions have targeted Russia’s financial system, cutting it off from the SWIFT international payment messaging network. In response, Russia is determined to reduce its dependency on the U.S. dollar and develop an alternative payment infrastructure.

China, while not directly affected by the sanctions, shares similar interests with Russia. Chinese President Xi Jinping sees the dominance of the U.S. dollar as a vulnerability and an obstacle to China’s global ambitions. In addition, China’s trade ties with Russia have strengthened significantly since the Ukraine conflict, giving Beijing both an economic and strategic stake in reshaping the global financial system.

The Expansion of BRICS and its Role

The BRICS group has expanded to include Egypt, Ethiopia, Iran, Saudi Arabia, and the UAE. With this enlargement, the group now covers over 40% of the world’s population and accounts for more than a quarter of global GDP. This expansion has provided a significant boost to efforts aimed at challenging the current U.S.-led financial system. BRICS members, many of whom have faced economic pressures from the West, share a common interest in creating a more balanced and inclusive global financial architecture.

At the heart of these efforts is the BRICS Pay system—a decentralized payment network intended to provide member nations with alternatives to SWIFT and the U.S. dollar. This system is designed to facilitate faster and cheaper cross-border transactions and reduce exposure to Western sanctions. Additionally, Russia has proposed a BRICS reinsurance company to ensure uninterrupted trade, especially in the face of Western financial constraints.

Measures Being Taken to Challenge the Dollar

China and Russia, along with their BRICS partners, are taking several concrete steps to build this new financial architecture:

- BRICS Pay: This is a payment system currently under development by the BRICS countries. Similar to Europe’s SWIFT system, BRICS Pay aims to streamline trade and transactions among member nations by enabling payments in local currencies rather than relying on the U.S. dollar.

- De-dollarization Initiatives: Both Russia and China have been vocal about reducing their dependency on the dollar. This involves promoting the use of local currencies in trade between BRICS members and other countries. For example, China and Russia have been conducting trade in yuan and rubles rather than dollars.

- Cryptocurrency Development: Russia is working on creating a cryptocurrency that could provide an alternative means of payment beyond the control of Western sanctions. The idea is that this decentralized form of currency could allow for more secure and private transactions.

- National Bank Networks: Moscow is advocating for the establishment of national commercial banks linked within BRICS, allowing these banks to bypass Western financial restrictions. This system would connect central banks from different countries to facilitate trade without converting local currencies into U.S. dollars.

- Reinsurance Mechanisms: Russia is also proposing a BRICS reinsurance company to mitigate the risk of Western firms refusing to insure critical trade goods, thus protecting essential supply chains among BRICS members.

Who Is Being Drawn into This Initiative?

Aside from the founding BRICS members, several countries have expressed interest in joining the initiative. Turkey, Malaysia, and Zimbabwe are among the nations considering aligning with BRICS. Even countries with strong ties to the West, such as the UAE and Egypt, are showing interest, motivated by the desire for economic diversification and independence from the dollar-dominated financial system.

The Likely Impact on the U.S. and the West

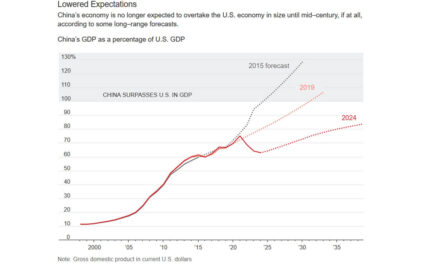

The implications of a successful shift away from the U.S. dollar could be profound. The dollar’s dominance in international trade and as the world’s reserve currency has been a pillar of U.S. economic power for decades. A viable alternative payment system could reduce global reliance on the dollar, making it harder for the U.S. to wield financial sanctions as an instrument of foreign policy.

However, there are hurdles. India, a key member of BRICS, remains hesitant to fully commit to a new monetary system that would challenge the U.S.-led order. Furthermore, many smaller BRICS members still depend heavily on trade with Western nations, complicating efforts to build a unified financial alternative.

In the long run, if China and Russia succeed in establishing a robust alternative payment system, it could accelerate the trend of de-dollarization. This would not only reduce U.S. influence globally but also open the door to a more multipolar financial landscape, where countries have greater freedom to operate outside of Western economic dominance.

Conclusion

China and Russia’s efforts to reshape global trade and payment systems represent a direct challenge to the existing Western-led financial order. The measures being taken through BRICS, including the creation of BRICS Pay and alternative reinsurance mechanisms, reflect the growing desire among emerging economies to diversify their financial dependencies. While these initiatives are still in their early stages, they signal a shifting world where the U.S. dollar’s dominance may no longer be as secure as it once was.

ACZ Editor: The threat to the U.S. and dollar is intentional, the goal being to lessen U.S. economic influence in the world. It would also be a major blow since the ubiquity of the U.S. dollar provides a buffer against inflation. Removal of this buffer would be a huge blow to our economy, in additional to the loss of influence. But our leadership seems to be oblivious.

BRICS has been around for a couple of decades and we are still number one.

However, that’s a gift, not a mandate, and to keep the dollar on top, we need to offer better features than BRICS. The dollar is already more sound than crypto and Russian crypto is nothing to fear — like a fly attacking the swatter.

In the end, if the world had a single money, the world would be a safer place. Money wars are the worst. Silent killer as it were.

So, keep your eye on the BRICS Pay System success since that’s the one that could affect the dollar. BRICS allows local currency use versus the dollar, fixing that will end BRICS. BRICS allows some sanctions to be skirted, that needs to be fixed too.

The rest is BAU, competition rules, and if we can compete, we can come out on top or equal. That’s the real heart of the matter. We know we cannot compete on labor costs, we must compete with innovation, service, and things outside of matching labor costs with low-cost countries. We need government out of the way or helping us compete against all comers. Then, protecting the dollar becomes far easier.

Competition is natural, the universality of the dollar is not a mandate, it’s a blessing for us, based on the strength and stability of the dollar. So far, the dollar remains quite strong, we have the best, and most vibrant economy on the planet, and just need to add features to the SWIFT payment system to compete with the BRICS advantages. No hurry, we have a big lead.

BRICS may be a threat to the dollar in the future, but not now. 1) The two largest economies in BRICS have been constantly feuding for years, India and China. As long as these two long time rivals continue their feuds, BRICS remains a fairydust dream. So, political disunity stops BRICs. 2) Many countries in BRICS have no common interests, and those that do are binded together by their dissatisfaction with the US. Example: Russia wants to see BRICS (as well as China) because their goal is to have unchallenged power with which to do land grabs and a world order that bows to their whims. 3) Historically, BRICS has not been able to deliver on its promises from previous summits. Thus, right now it is a feel good meeting similar to Christians who go to Church on Easter and Christmas, and ignore God the rest of the year. 4) Western countries will be very hesitant to participate because it is viewed as a threat to existing world order – So BRICS cannot count on the West where much of the wealth is located. 5) Some BRICS countries such as China and Russia havce exaggerated ambitions for BRICS. 5b) And then there is India and Modi who are playing the middle game for all it is worth as they attempt to balance their need for Russian arms and oil against U.S. technology and access to bigger markets. My observations of “middle of the roaders” are that they are rarely fully accepted by either side of the road. 6) Domestic headwinds of the big three as well as all of the little countries will stall efforts and present constant threats to efforts. 7) Many other countries wanting to be in BRICS for what it can do for them, but they have little to offer and expansion will become a drag on expansion of BRICS. 8) Anti-West sentiment will become more confrontational which will cause headaches for fence straddlers like India, and will further cause the West to shift commerce away from BRICS confrontational countries to countries more neutral. 9) BRICS countries tend to be politically and economically more unstable – but to this extent the U.S must get its money printing under control and show the world it can reduce its internal debt. U.S. economy is not growing as fast as its national debt – and this causes worry that leads to other countries looking at BRICS. 10) China, Russia, India together do not have as much regulatory requirements as the U.S. which means higher risk of relying on a BRICS system.

There are headwinds that will cause failure of the BRICS group such as: 1) Inability to merge related systems due to different political systems. 2) Widespread doubt that a BRICS currency would be as stable as the current dollar system. 3) Widespread disparity between China which is 50% of BRICS wealth and other smaller countries. Just look at what China tried to do to Lithuania when Lithuania set up a Taiwanese Embassy in country. China attempted economic blackmail – so what is to stop China in the future? 4) Internal tensions such as the border disputes between China and India, and I expect when Russia loses its war of aggression against Ukraine, China will see the opportunity to take back Mongolia which will create tensions, not to mention the cracks in the relationship now! 5) Expansion will complicate consensus building which is required for a viable and stable system. 6) Lack of clear strategy and common core values have resulted in BRICS not having any clear entry level criteria for countries to join, nor are there any publications of common core values among the existing BRICS countries. 7) Inadequate financial structure will prevent local currencies to be used in cross border transactions – again, China is the only country in BRICS that could even attempt to provide enough gold backed currency (such as the Yuan) which is what it is attempting to do now. So BRICS will need infusion of dollars which defeats the purpose of BRICS. 8) De-dollarization will require countless exporters, traders, importers, borrowers, lenders, and others linked to world financial systems to agree to the switch to the less stable and robust system that BRICS offers. 9) Transparency will be required and this is a requirement that countries such as Russia, China, India, Iran, North Korea, and some other member countries cringe at and will not do.

In conclusion, the Dollar system is safe for now and for the next two decades. But the U.S. would be wise to look at the core reasons why countries want to go to BRICS and incorporate some of those features into the Dollar system to remove incentives to migrate to BRICS.

Also in the end, I see a financially bifurcated world where there are two financial systems but the lead system will still be the Dollar, and there will be many fence straddlers!

If Kamala wins, we will start to adopt Brics slowly by slowly in about 2 years.

All part of the One World Order!

There is no evidence to support your ridiculous assertion Darren.

Darren,

economically, politically, rationally, that just does not make logical sense.

it appears you made this one up totally, there are no experts saying anything like it.

very weird thought

You also told me Illegals’ can not vote!

Right!

Correct Darren.

BRICS is NESARA/GESARA.

Dangerous hacker Stranger Danger: I left you a new comment from yesterday. IT’s not dead yet, continuation of it whether you like it or not.

In my opinion, if they exclude the dollar they forfeit all debts that came from accepting the dollar in the first place.