Will China Ever Surpass the U.S. Economy?

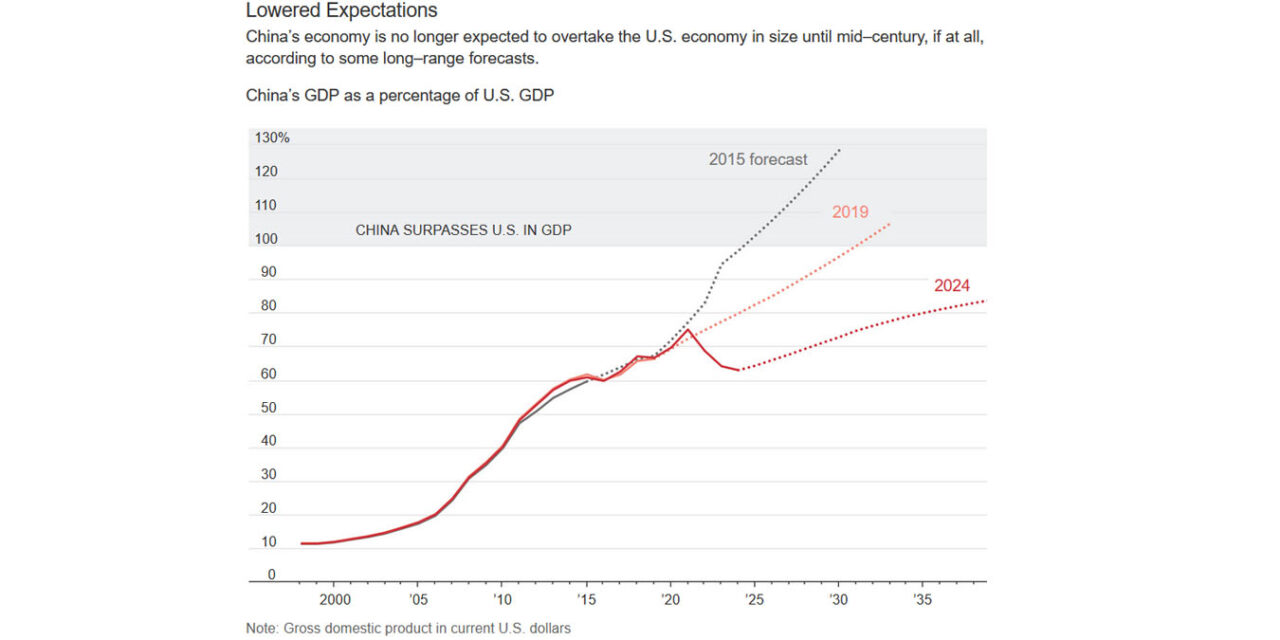

For decades, economists and policymakers predicted that China’s rapid economic growth would allow it to surpass the United States as the world’s largest economy. Once seen as an inevitable outcome, this forecast now appears uncertain. Structural issues within China’s socialist economy, totalitarian demographic challenges, and the aftermath of a catastrophic real estate bust have slowed its momentum. Today, experts suggest that China may not overtake the U.S. in GDP until at least 2050—if it ever does.

The Shifting Forecasts

In 2019, projections suggested that China’s economy would eclipse the U.S. by 2030. However, recent developments have significantly altered those forecasts. The U.S. economy remains resilient, bolstered by innovation, strong consumer spending, and a robust service sector. Meanwhile, China’s economic engine has stumbled, dragged down by overbuilding, mounting debt, and a shrinking workforce – all of which, incidentally, caused by their socialist totalitarian government.

According to the Centre for Economics and Business Research, China might not surpass the U.S. economy until mid-century, if at all. Some experts, including former U.S. Treasury Secretary Lawrence Summers, even argue that China may never take the top spot. “I think there is a real possibility that something similar would happen with respect to China,” Summers said, drawing parallels between China’s current situation and past overestimations of Japan and Russia.

Instead, its economic trajectory could mirror Japan’s experience in the 1990s, where rapid growth gave way to stagnation. As Anne Stevenson-Yang, co-founder of J Capital Research, bluntly put it, “Erratic and irresponsible policies, excessive Communist Party control, and undelivered promises of reform have created a dead-end Chinese economy of weak domestic consumer demand and slowing growth.”

The Real Estate Crisis: A $18 Trillion Implosion

At the heart of China’s economic struggles lies its real estate sector. Once a cornerstone of growth, the property market has crumbled under the weight of excessive borrowing and speculative investment. Since 2021, the property meltdown has erased an estimated $18 trillion in household wealth—a figure larger than the losses seen in the U.S. during the 2008 financial crisis.

Millions of unfinished or vacant apartment units dot China’s cities, symbolizing the fallout from unchecked development. Despite government efforts to stabilize the sector with stimulus measures and policy shifts, consumer confidence remains weak. Households, having seen their wealth evaporate, are reluctant to spend, further stalling economic recovery.

This real estate collapse is deeply tied to government policies. For years, China’s socialist economic model encouraged overbuilding, as state-backed developers pursued growth targets rather than market demand. At the same time, local governments became reliant on land sales to finance their budgets, creating a vicious cycle of debt and construction.

The One-Child Policy and Its Aftermath

China’s one-child policy, a totalitarian demographic experiment enforced from 1980 to 2015, has had devastating long-term consequences for its economy. While the policy succeeded in slowing population growth, it also created an imbalance in the age structure of the population.

Today, China faces a demographic time bomb. The country’s working-age population is shrinking, while its elderly population is expanding rapidly. By 2035, one in four Chinese citizens will be over 65. This demographic shift means fewer workers to drive economic growth and more strain on social welfare systems.

“Historically, no country has managed to achieve 4% growth in the subsequent 12 years after the elderly made up 15% of the population,” noted Fu-Xian Yi, a demographer at the University of Wisconsin–Madison.

The one-child policy also resulted in a gender imbalance, with far more men than women in the population. This imbalance contributes to social instability and reduces birth rates, further exacerbating the demographic crisis.

Manufacturing and Overcapacity

China’s manufacturing prowess remains a core strength, dominating industries such as electric vehicles and renewable energy. However, manufacturing has also become a source of economic imbalance. Excess industrial capacity has led to falling prices for Chinese goods and increased reliance on exports. This has sparked trade tensions with the U.S., Europe, and emerging markets like India and Brazil.

While China’s factory floors remain productive, the country’s dependence on manufacturing exposes it to global market volatility and trade barriers. According to economist Mark Williams, “A lot of people for a long time have overestimated the competence of China’s leadership and have been shocked by the missteps with Covid and the property sector.”

Is China the Next Japan?

Parallels between China and Japan’s economic trajectories are hard to ignore. Japan’s bubble economy of the 1980s burst spectacularly in the early 1990s, leading to a prolonged period of stagnation. Many economists worry that China could face a similar fate due to its real estate crash, high debt levels, and an aging population.

However, China does have some advantages over Japan. Its population is much larger, urbanization is ongoing, and sectors like technology and green energy offer growth potential. But whether these factors can offset its structural weaknesses remains uncertain.

Justin Yifu Lin, former Chief Economist at the World Bank, remains optimistic. He argues that China’s larger population means the country’s economy will eventually outpace the U.S., saying, “As long as Beijing maintains internal stability and external peace, the Chinese economy will soon overtake the U.S.”

U.S. Resilience vs. China’s Uncertainty

While China’s economic slowdown continues, the U.S. economy remains a global powerhouse. The United States benefits from high productivity, a dynamic private sector, and the dollar’s status as the world’s reserve currency. Despite political polarization and economic challenges, the U.S. economy has proven remarkably adaptable.

Looking ahead, the Congressional Budget Office projects moderate but steady growth for the U.S., averaging around 2% annually over the next decade. In contrast, China’s growth rate is expected to slow to around 3% by the early 2030s.

For China to have any chance of overtaking the U.S., it must address its core challenges: stimulate domestic consumption, reduce reliance on debt-driven growth, and reform its aging social welfare system. However, these changes require significant political and economic reforms—steps that China’s leadership appears reluctant to take.

Ultimately, GDP rankings tell only part of the story. Even if China surpasses the U.S. in raw economic size, the U.S. will likely remain far wealthier on a per capita basis. Additionally, America’s global influence, driven by financial markets, innovation, and cultural exports, will continue to shape the world economy.

The race between China and the U.S. is no longer about who will become the largest economy, but rather about who can build a more sustainable, resilient, and innovative economic model for the future.

In the words of economist Andy Rothman, “Looking at the Chinese economy and the U.S. economy as a zero-sum game isn’t accurate. Both economies can thrive, but only if each country addresses its own unique challenges.”

PBP Editor: China was cheating. They began building housing at a massive rate on borrowed money, and it became a major addition to their GDP, and a wealth placeholder – typical socialist thinking. But that has collapsed. They built their manufacturing base on the subsidized flooding of foreign markets and stolen technology. The West is getting wise, and manufacturing is beginning to move out.

Here is an Idea, let China tear down their borders and allow every

A Hole into their country while the Government Lies to their people?

Would that not fill up all the empty housing?

Seems that is what the current U.S Government has done the last 4 years!

Or maybe the current Chinese Government was waiting for their Lap Dog Biden

to make them prosperous while the U.S. economy sinks to its lowest!

After all, there is a Payday waiting at the end for Traitor Biden.

And the current Gov has the gall to criticize Trumps picks!

Sorry, but for the next 4 years China is on their own!

Thank God Trump Won!!!!

They have lots of people, but those people can’t afford to live there – which of course means that the buildings are not worth nearly as much as they thought because rents will need to be lower to fill them up. This is the problem with socialist thinking, they don’t understand that if nobody can live in the buildings then they don’t really serve a purpose.

For all those who don’t approve of American style democracy, free enterprise, and monitored capitalism Consider the alternative government regulated economies like Russia, China, North Korea, and other rightist governments. What percent of government spending go to their military, to the party’s leadership, and what is left for the greater good of all its citizens.

In America the rich are getting richer off the honest hard working working and middle classes. Our GDP should be made to be unreachable by China or any other nation’s economy. But for the 1% who spend on elections from the billions of dollars that should go to pay down our government’s debt. Not paying the country for its advantages in infrastructure, education of industry’s workers and their children, the amount of law and order in this country that allows free flow of material for industry which industry depends upon. The injustice of the lopsided tax structure at one time was justified by the rich and grossly wealthy was the economic concept of “trickle down economics”. Reagan came out with the theory that profits earned by the titans of industry and finance would be turned back in industry’s modernization and efficiency, which Reagan proposed would benefit workers and management classes better working conditions and pay increases.

The reality promised never made it down to those promised in even a trickle in wage workers’ increases. Reagan’s theory was a rewording of an ancient concept in economics that proported much the same. It was said by the merchants, the nobility, and the leisure classes of the day that “a rising tide lifts all ships” meaning that when the economy is good everyone benefits. That analogy quickly falls apart when we think about who actually has access to tidal water. Of coarse, it’s only those in boats and ships. It’s the same with trickle down, only those with economic leverage like company ownership, or considerable wealth in stock ownership, or land possession in 100’s and 1,000’s of acres for development into multi-use parcels.

Only the those with capital have leverage in a capitalistic economic system. China, for one, does not offer that system in it communist regime. But the Communist Party will give free trade capitalism to a very few of its elite party members and these people are the super wealthy industrialists and shipping magnates. However in return for their given privileges unknown to their fellow citizen the few must stay in the good graces of the head of government at the time. Good standing with the Chairman is bought and paid for in momentary and universally valued commodities. Honor amongst thieves has the same flavor as what ever grace allowance exists in their transactions.

China’s gains on the U.S. in the common economic term understood universally as GDP Gross Domestic Product are often caused by China’s bureau of all things connected to GDP numbers calculation. That Bureau often referred to as China or the Chinese has been caught cheating and lying about their artificially increasing one pr more of the variable factors used in calculating GDP for the country.

Real estate stock available for sale, sold, and occupied in a single year is a factor in that calculation. True in China is the continuing existence of a financial black cloud threatening a tsunami size wave of past due debts that will wash out to sea their houses built on speculation alone. After counting the billions of citizens who course use a new home the bureau charged with homes being occupied has its orders, but too few applicants with means sufficient to purchase and occupy existing houses is an issue. No money from home sales and developers’ debt payment approaching and financial inability of developers’ management of the interest expense on the loan’s principle balance is worrisome. The CP Chairman, hence the nation’s supreme leader, Chairman has no wish to or possibly uncommitted budget reserves sufficient if push came to shove. Kind of similar to our nation’s banks receiving buyouts from the U.S. Treasury so the few the politically right leveraged could survive (?). And survive they did, but on whose dime. The government treasury’s dime, which is by extension yours and mine paid with tax money we paid under threat of fines or worse for lack of payment.

We have seen in our news feeds that a few celebrity status individuals have been found guilty of tax fraud. But by some miracle of accounting or the IRS’s fear of a public pit cry in support of Mr Trump.

He seems to have skated on his tax obligations to the IRS. His only defense is that he had a high paid smart accountant. He said he is rich and he could afford the expensive smart accountant who knows all the loopholes in IRS law. Trump could be the poster child of an American oligarch. But he is but

a mere shadow of the wealthiest Oligarch in all the world of oligarchy. Elon Musk has that award attached to a red ribbon and slung around his neck for show.

The oligarchs in China prevent China’s GDP from

gaining on America’s top rank status. Then, America’s own oligarchy with billions in worth and pay a small percentage of their annual corporate income and personal income in corporate and personal income taxes.

As long as China’s wealthy oligarchs continue taking the amount thought to be their share they are likely to a ships anchor dragging along the ocean’s bottom causing damage and disconnections wherever it runs.

America’s 1% populate the most wealthy segment of the Census count. In sum their wealth together approximates 90 to 95% of all the wealth held by persons and their corporations in this country. Many, like E. Musk, have branches of their company in other countries. Musk owns his largest Tesla plaint located in China, of all places. If the income tax laws where revised to include wealthy income earnings are taxed at a rate comparable to the average citizen’s income tax bill, wouldn’t the treasury find sufficient funds with which the U.S. government will pay at least the interest due payment. This year with not tax rate increase for the wealthiest and Trump in office driving the deficit higher by borrowing more. His actions will result in this country’s financial bankruptcy and loss of Bond Rating and World Bank trust rating most used when granting loans.

Trump as President is emboldened by his status which will have him ordering the U.S. Mint into printing an excess of bills and devaluation of theUSD against world currency rates. Last fall the USD was worth 70 cents compared to yhe UK’s 1 pound sterling. America’s Trump printing more money and mishandling the nations debt will result in

At least a recession if not a full blown financial economy’s depression.

Should America’s economy faultier and fail the whole World Market will soon follow into economic depression. Republican have been removing any economic brakes they believed stood in the way of their wealthy supporters’ evermore richer schemes.

This all may well ensure China claim on the biggest economy in the world.

China thought they were so smart by limiting to one child household. They were so smart, they outsmarted themselves. Stupid people. As the children grew to adulthood, China was knee deep in adding the young adults to their military. Where are THEY housed? Evidently not in those unused homes. China is so hated by most countries they will never succeed. Who cares?