Middle East to Freeze Oil Output

As we predicted back in November, today’s low oil prices won’t be around for long. This week, both Russia and Saudi Arabia made tentative offers to freeze oil output in an effort to halt the ongoing slide that has sent the price of crude oil to levels we haven’t seen in over a decade.

It was rumored a couple months ago that these low prices were a strategy by Saudi Arabia and other OPEC nations to kill off the threat from shale producers in the US. It seems they couldn’t hold off any longer.

Major oil producers met behind closed doors this Tuesday to formulate a plan to combat plummeting oil prices. Alexander Novak – Russia’s energy minister – announced that his country has agreed with Qatar, Venezuela, and Saudi Arabia to freeze oil production at last month’s levels if other producers follow suit. This announcement reflects major oil producers’ concerns about the economic effects of the ongoing slump in crude oil prices.

“We are ready to maintain on average in 2016 the level of oil production of January 2016 and not exceed it,” said Novak.

Whether this plan is enough to make a different is uncertain. The unexpected proposal depends heavily on cooperation from many different producers, each with their own budget priorities. Iran will likely be the hardest to bring on board. Iran was suspiciously absent from Tuesday’s meeting, despite the fact that it shares control with Qatar over a giant underwater natural gas field.

Iran is eager to increase exports in the wake of the nuclear deal. In December, before sanctions were lifted, Iran reportedly pumped just under 3 million barrels per day. Now, in the wake of the nuclear deal, Iran is eager to add up to 500,000 barrels per day to the market.

Iran will not “overlook its quota,” even though the global market is “oversupplied,” said Bijar Namdar Zangeneh, Iran’s petroleum minister. His words suggest that the Islamic Republic has no interest in relinquishing its share of the market.

“The key OPEC members that need to take part are Iran and Iraq, where the big increases are likely this year, but there are big doubts over whether this can be achieved,” wrote Barclays analysts Kevin Norrish and Miswin Mahesh.

A deep level of mistrust between Iran and Saudi Arabia further complicates matters. Saudi Oil Minister Ali Naimi told reporters this week that freezing oil output at last month’s levels would be an “adequate” step. He added that oil producers would keep a close watch on the state of the market in upcoming months.

OPEC’s keep-pumping strategy is aimed to ride out the ongoing slump in order to force higher-cost producers like US shale drillers out of the market. The bloc of nations pumped 39 million barrels of natural gas and crude oil each day in December 2015. Russia, which is not an OPEC member, pumped about 11 million barrels per day.

Economic analysts remain skeptical, saying that even without the plan to freeze output, Russia and Saudi Arabia probably would not have boosted production. “For the deal to have any teeth, Saudi Arabia in particular needs to be willing to cut output, not least to offset the increased supply still to come from Iran,” said analysts Thomas Pugh and Julian Jessop.

As of today, one barrel of Brent – the international standard – is currently trading at $33.42.

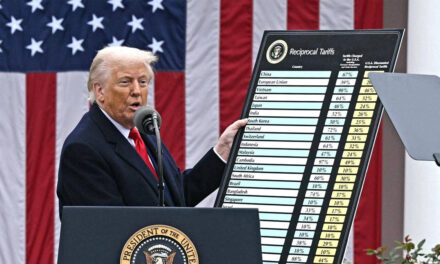

“There are methods which you could do it,” said Trump when asked about a third term just this weekend. “I’m…

Larry, while I tend to agree that a trump third term is highly unlikely-it is not for the reasons that…

From media bias/fact check: "Overall, we rate The American Alliance for Equal Rights as right-biased based on advocacy that favors…

Here's hoping we do not repeat history! Reed Smoot, Chairman Senate Finance Committee April 18, 1931 "One of the most…

Where did Trump's tariff plan, if you can call it that, come from? Trump has talked tariffs well before politics…