Fighting Inflation: Fed to Hike Interest Rates in March

Federal Reserve officials this week hinted at plans to raise interest rates in March to combat rising inflation – marking the first change to the agency’s benchmark rate since December of 2018.

Officials are also expected to announce a final round of asset purchases and to resume talks on how to how to ‘significantly reduce’ the Fed’s nearly $9 trillion balance sheet. Goldman Sachs predicts the agency will try to shed $100 billion a month starting in July.

The Fed believes a rate increase will help slow the pace of hiring and income growth, resulting in decreased demand and decreased inflation. Other factors expected to calm inflation include:

- A shift in demand from goods to services.

- Supply chain issues being resolved.

- The Fed’s potential elimination of mortgage-backed securities from its balance sheet.

“If they want to tighten financial conditions, they want to slow inflation, the number-one contributor to inflation in 2022 is going to be housing-related inflation,” says Barry Knapp, head of research at Ironsides Macroeconomics. “Goods prices will come down, supply chains will clear. But that increase in housing prices and rental prices, that just is going to keep going up. It’s already above 4%. The Fed’s primary channel for slowing inflation in this case is via the housing market.”

Speaking to lawmakers earlier this month, Federal Reserve Chairman Jerome Powell claimed that rising inflation is a result of changes to supply and demand: “Supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation.”

When the central bank cut interest rates to near zero in March of 2020, officials said rates would remain low until unemployment improved and until inflation was projected to exceed 2%.

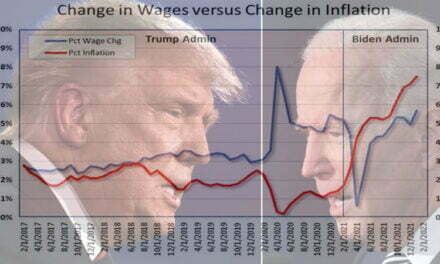

Inflation jumped to 4.7% in November of 2021 before dipping to 3.9% in December and has not improved since. Consumer prices are increasing at roughly 7% – the highest since 1982.

The unemployment rate is currently about 3.9% compared to 3.5% before the pandemic and down from a peak of 14.8% in April of 2020.

With both of the Fed’s conditions for a rate increase having been met, the agency is expected to hike rates by .25% or more in mid-March.

Economists predict between two and five additional increases by the end of the year and at least three next year, but this strategy could change if inflation remains above 3%.

“To the extent that [the] situation deteriorates further, our policy will have to reflect that,” notes Powell. “This is going to be a year in which we move steadily away from the very highly accommodative monetary policy we put in place to deal with the economic effects of the pandemic.”

Other factors that may cause the Fed to change its strategy include stock market activity, COVID variants, and whether Russia takes action against Ukraine.

The S&P 500 dipped 11% in response to the agency’s announcement this week, but yields on Treasury securities increased.

Author’s Note:

In the words of my colleague Joe Gilbertson, the problem with a rate increase is that it also raises the interest owed on our national debt and prompts the government to print more money (or raise taxes or cut spending – neither of which they seem capable of), which causes inflation to rise. They will soon find out that that their tools to fight inflation don’t work so well.

Sources:

Fed Expected to Signal Interest-Rate Increases to Start in March

https://www.wsj.com/articles/fed-expected-to-signal-rate-increases-to-start-in-march-11643193004

Fed likely to hike rates in March as Powell vows sustained inflation fight

The Fed is likely to signal a March interest rate hike and that further policy tightening is coming

https://www.cnbc.com/2022/01/25/the-federal-reserve-is-likely-to-signal-a-march-rate-hike.html

Inflation surge could push the Fed into more than four rate hikes this year, Goldman Sachs says

OK, I get it, your a reporter reporting on the news.

Nothing better than reporting based on a “hint.” And with this conclusion: “In the words of my colleague Joe Gilbertson, the problem with a rate increase is that it also raises the interest owed on our national debt and prompts the government to print more money (or raise taxes or cut spending – neither of which they seem capable of), which causes inflation to rise. They will soon find out that that their tools to fight inflation don’t work so well.” That does not seem like reporting, that seems like pontification. Opinion.

Except, in your digression from “hint” reporting into the land of guesstimates, you leave out the fact that this only affects current debt between 5 – 10 years from now when those “loans” expire and new debt is established. IOW, you spin it to sound like we instantly pay higher interest costs. That is true —- for new loans, T-bill sales only. NOT FOR THE EXISTING ONES, that deal stands. They are not floating rates; the interest on the lion’s share of the debt DOES NOT CHANGE for existing T-bills. The price may change, but that’s the owner’s issue, not the governments.

And you seem to leave out that higher inflation affects everything the government buys. So which is worse, higher prices for goods and services, or higher cost of debt? Do I see smoke coming from your ears? :>)

Not to mention inflation causing reduced savings rates reducing investment spending (like T-bills), capital formation, resulting in slower economic growth. Or other economic factors affected by inflation, or by interest rates.

Point is that your spin that rising interest will cause more debt is more complex than the simple binary spin you provide. You see nothing but harm, provide an example, debt, that you spin and leave out the difference between existing debt and new. And, of course, you see no alternative, just that anything done in the time of Biden must be bad……even if it’s the Fed….

I mean WTF do you have in your tool box to fight inflation versus the traditional financial tool of raising Fed rates? What’s in your wallet?

Crickets????? yech.

If you knew anything about the Fed, you would know the Fed works entirely on “hints” They don’t want surprises.

And yes, about the crickets… still crickets. Scared yet?

Isn’t a hint a surprise? Isn’t this hint a surprise? Surprised you didn’t realize that :>) The stock market was surprised…..it says so right here. Aren’t you talking surprise no matter what, it’s just the timing of the surprise that apparently surprises you?

Glad you really focused in on the big picture with your big takeaway….crickets.

If we had a better president the rates w we not be raised. The voter fraud people got what they asked for

I am sorry, but voter fraud again? Are you folks really this stupid? Have you become total Trump sheep? You do know he kills all he catches, don’t you? When will you realize what’s in front of your eyes and quit believing The Big Lie?

The Heritage Foundation, a conservative think tank, with real conservatives, has a database which, bluntly states, you are completely full of shit. Less than 20 convictions. Some are on the family plan, husband and wife team with the CA conviction for 7 people trying for around 100 votes. Most of these are penny Anny and local or state in scope.

https://www.heritage.org/voterfraud/search?combine=&state=All&year=2020&case_type=All&fraud_type=All&page=0

And for Joe —– there’s your fucking fraud database, constructed by conservatives, showing nothing for 2020.

Clifford, YOU are the voter fraud people. And frauds. And getting really boring to hear your freakin lies still.

So stay off this site

Wait, so you’re upset at my boredom? That’s what bugged you most in my post? Man, that’s one brick shy of a wall ;-).