New Payday Lender Loans in Arizona: A Heated Debate

Tuesday: the Arizona House gave tentative approval to a proposal that would allow previously-barred payday lenders to offer new high-interest loans. More than an hour of heated arguing preceded the voice-vote on Senate Bill 1316. The debate pitted Arizona Republicans backing the new loan offerings against Dems who slammed the product for its exorbitant interest.

The proposal, introduced by Senator John Kavanagh, would allow “flex loans” with interest rates between 15-17% a month. It’s a restructured version of a similar bill that failed in 2015.

The Dems fiercely oppose the proposal, complaining that it would draw loan sharks back into Arizona. In 2008, voters heartily rejected a proposal that would have allowed payday lenders charging up to 400% annual interest for non-secured loans to remain open permanently. Those lenders were forced to close in 2010 when their temporary authorizations expired.

A similar ban was successful in New Hampshire in 2008, pushed mainly by former State Rep. Mike Kaelin. “Its terrible for the consumers, if you think 22% per year is bad on your credit cards, try rates of 300, 400, or 500% and that’s on the low end. These are provided to people who already are in debt. A thousand dollar loan can cost you $200 to $300 per month, and that’s forever!” he said. The bill was overturned two years later due to bank lobby pressures.

Under Kavanagh’s proposal, the new “flex loans” will be unsecured by vehicle titles or other collateral and will carry an annual interest rate of 200%. That means a $2,500 loan would end up costing you $10,000 – if you paid it back in two years.

Arguing with Republicn Rep. JD Mesnard, Democratic Rep. Debbie McCune Davis asked, “I know that you believe that this could provide some benefit, but why would we allow out-of-state companies to come in here and re-establish predatory lending in this market?”

Mesnard replied that low-income individuals with bad credit need access to loans for emergences. The alternatives are far worse, ranging from loan sharks to illegal online lenders. “There’s nowhere for folks to go so they go to loan sharks who will maybe chop off their fingers if they don’t pay back a loan, or they’re doing something online illegally,” said Mesnard. “They will have consequences far more severe than the very few if any consequences that are outlined in this bill because of the protections we are putting in place.”

Mesnard also questioned why they should dislike out-of-state companies, saying, “There’s nothing wrong with that. Where they choose to headquarter they choose to headquarter.”

The House will hold a formal vote on the issue later this week before sending it over to the Senate.

If ya'll say so, E.D., then it must be so. MSNBC vs PBP challenge and compare. Scandals, they pop up…

Whoops, I meant Robert.

I was referring to Roger being mentally unhinged. He's the one that was ranting. Hell, I support Trump. I don't…

Your daughter

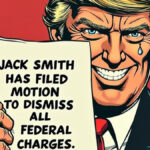

I noted in another post that if I were king of the forest....... I would pardon all the non-violent 1/6…