Hopefully Biden will lose on student loan forgiveness … again

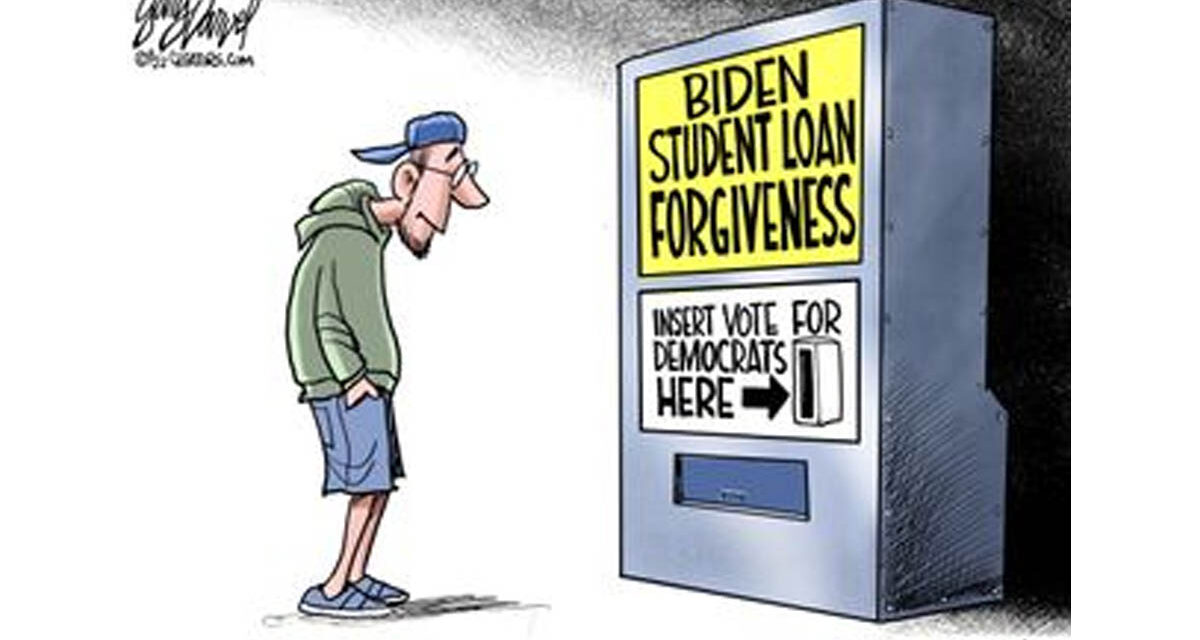

President Biden is making a second attempt to buy votes with taxpayer money by making you and me pay for $146 billion in student loans. This, despite the fact that the United States Supreme Court – in a 7 to 2 decision – declared Biden’s previous abuse of power unconstitutional less than a year ago. (Incidentally, the Biden student loan proposal would cost taxpayers more money than the proposed legislative aid package for Ukraine, Israel and to secure the southern border COMBINED.)

You might think that the Supreme Court decision would have settled the matter. But nooooo! Biden & Co. searched for alternatives to finance their bribes-for-votes scheme –one they hoped would pass Supreme Court muster. Now they claim they have one.

The Biden Scheme

The new scheme has several basic provisions. It would:

- Forgive $20,000 in interest for millions of borrowers.

- Forgive the debt to those pleading “hardship.”

- Forgive repayment of 20-year-old loans to those with undergraduate degrees – and 25 year old loans by graduates.

One of the more interesting provisions is the automatic cancellation for eligible students who have not yet applied. Not sure how that works.

According to Education Secretary Miguel Cardona, in a CNN interview, debt cancellation would also apply to students who did not get fair value for the education provided. He is obviously thinking of the so-called “degree mills.” But could that be applied to Harvard or Yale? A lot of those students would say “yes.”

Cardona also indicated forgiveness would apply to loans in which the interest is now larger than the loan. Of course, that means the borrower has not been paying off their loan. Potentially the deadbeat gets the greatest benefits.

Viva la difference

So, how does this plan differ in terms of the Constitution – which Biden’s last plan violated?

According to Biden, the new scheme is more targeted. His original effort was to cover 43 million borrowers in a blanket approach. The new plan covers approximately 25 million borrowers based on specific conditions – such as older loans, unpaid loans or personal hardship.

The old plan was based on the Heroes Act. In the new scheme, Biden is attempting to use the federal rulemaking process. The legitimacy of this effort will likely again be brought to the Supreme Court. Already three state attorneys-general have filed suits against the new plan.

As in all situations, there are lawyers on both sides. It appears from media reports, however, that most legal scholars believe the Supreme Court will view Biden’s new effort as a difference with a distinction.

What is so bad about forgiving the loans?

Outside of Biden’s political self-interest and the schemes questionable constitutionally, it is a very bad idea on its own merits.

Basically, Biden is arguing that the President of the United States has the authority – by Executive Order – to shift the obligations of student loan recipients onto the American taxpayer. In other words, Uncle Sam (you and me) will pay off the financial obligations of millions of students.

What is noteworthy in the Biden scheme is that not only will the students be free of legally incurred debt, but the Banks will be made whole. In addition, there will be no collection problems for all those lenders.

The Universities that sucked the financial blood out of the students – and were the greatest beneficiaries of the god-awful Student Loan Program — will not suffer any losses. There can be no argument that the Biden deal will benefit a lot of students, the lending institutions and the universities. So, who gets hurt. Just about everyone else.

The most obvious is the American taxpayer who will be paying the bill. We get screwed. We will either see our taxes go up to pay off the debts – or Uncle Sam will have to borrow the money. The latter is the most likely since we are already billions of dollars short of paying our federal government bills. Just check out the deficit and the National Debt. The Washington establishment no longer TAXES and spends, it BORROWS and spends.

It is not just the matter of shifting the burden from the borrower to the taxpayer. No. No. No. It is not just a matter of trashing the Constitution. No. No. No. The entire plan is ruthlessly pragmatic politically and unconscionably unfair.

It is a slap in the wallet of all those who have dutifully paid off their student loans. And now Biden wants them to help pay off all those other students’ loans – including the deadbeats who have compiled lots of interest or penalties. And what about all those students who tightened their belts and avoided taking out student loans – especially those 6-figure loans? They would be paying for student loans they neither applied for nor received. And of course, those who did not go to college are now paying off other people’s college educations.

Student loan recipients are also victims

Biden’s scheme is wrong constitutionally and wrong politically. However … that is not to say that the individuals with unpaid student loans are victimless. The entire Student Loan Program was designed to make them victims.

They were merely the conduit through which taxpayer money flowed to the colleges and universities. The loans were essentially a taxpayer gift from the progressive D.C. establishment to their progressive academic constituents.

The Student Loan Program enabled the major academic institutions to raise their tuition and other costs far greater than inflation. More money means higher prices. That is why the Student Loan Program provided money FAR in excess of the needs of the student and the university. It provided a windfall for the colleges and universities – and they sucked in the money with a vengeance with much higher-than-inflation increases in tuition and other charges.

To appreciate the magnitude of academia’s treachery in this matter, consider the astronomical costs of today’s education – tuition and other costs — at top universities. Harvard is currently at $83,000, Princeton $87,000, Yale $91,000, Brown $92,000, Wellesley $92,000, Tufts $96,000. And that folks is PER YEAR! It was the Student Loan Program that has enabled schools to charge such exorbitant rates.

Imagine … four years at Tuft University for $384,000 dollars. Even with scholarships and university-provided financial assistance, the amounts students are required to pay are outrageous. The market value – in terms of postgraduate salaries — of even those elitist educational institutions is simply not worth it.

Less prestigious schools – and even the “diploma mills” – have also unfairly benefited financially from the excesses of the Student Loan Program.

It is one thing to recognize that the student loan recipients were screwed by the loan program and another to shift that burden and screw the taxpayers. Any correction applied to the problem should rest on the shoulders of those who had the most wrongful gain – the colleges and the Universities.

My approach would be to pass legislation essentially requiring a partial refund on ALL student loans. I would also restrict the levels of student loans to make less money available for such obnoxious tuition increases. I would also use the federal grants to colleges and universities – and there are a lot of them – to force a reduction in tuition and other costs. This may require the largest universities to dip into their multibillion-dollar endowment funds that were so greatly enhanced by the Student Loan Program.

Final note

If the Biden plan were to pass Supreme Court muster – which I personally doubt — when would the first student loans be forgiven? According to the White House “sometime in the Fall.” The first thing to understand is that means it will not happen until sometime in 2025 – and certainly not before the November presidential election.

That is significant. I suspect Biden knows that his plan will not be approved by the Supreme Court – and that could take months. Consequently, he will be peddling his student loan forgiveness scheme as a campaign theme – whether it becomes real or not. By the time the student loan recipients learn that they are not getting any of their loans forgiven, the November election will be over. Biden is not only selling a pig in a poke but likely selling a dead pig.

So, there ‘tis.

Biden didn’t lose on the loans, he won twice. He got elected on it and then won again when he didn’t have to do it. Now, he may win again by using it to win his second Presidential and no way does he have to actually do it —- it’s his second term, he does not have to do anything to get re-elected for a third.

Yup, this is as good as a Trump stimulus in the 4q of 2020 to attempt to buy that election. Perhaps a little less transparent as Hoirst can’t see the triple win Biden pulled off while getting two bites at the apple.

I don’t think he won on this loan scam, he was placed by the Obama/Corrupt administration and I do not think he got the votes that we were lead to believe. The supreme court is not as stupid as some of the morons who believe that the government is going to pay for all of their shenanigans. The fools who voted for someone like Biden, are just as dumb as he is!

When they start paying for tuition scam, I want Biden to pay for my car or my house loans? Think it will work?

Marie … I tend to agree. I did not think Biden would gain votes. Considering the backlash by those who paid off their loans or did not get any, Biden may be losing as much as he gains. For whatever the reasons, Biden is not doing well with the younger generation — whose with the highest student loan balances. I also believe that a lot of those with student loans believe that Biden is selling them something he does not expect to deliver upon. You would have to be a fool to think Biden’s scheme is a big win for him.

He didn’t win on college loans you fucking idiot. He didn’t win. Voter fraud. Don’t try it again.

Larry,

You were born yesterday? You are not aware that presidents have been trying to buy votes since the office was invented 240 years ago? Every politician I’ve ever known, no matter where or when, is always trying to buy votes. Some are more obvious than others, but they all do this.

If you do not like this system maybe you should move to a country with one man rule, where buying votes in unnecessary. Think North Korea, or Russia.

Andrew Gutterman. Thanks for the question. Ohers on here think I was born in the 19th Century. You are right, of course. Politicians have been using taxpayer money to buy votes. It is the nature of the beast. That is the entire reason for earmarks. What draws special attention to Biden’s scheme is that (1) it is so flagrant, (2) the size of the bribe is enormous, (3) it is unconstitutional and the Supreme Court has told him so once and (4) it is grossly unfair a lot of folks. It is particularly devious because I believe he knows it will not happen.

I have to admit I like the American system less and less as we move to a centralized government nanny state, but I cannot go to North Korea or Russia since my concern is that we are becoming more like them.

My sister’s kids had to pay off their loans because they made to much money to get a free ride. I don’t want to pay for student loans for their basket weaving , gender studies, drinking party time 101 and the other moron classes they take. They can’t pay back the loans because they don’t learn anything that would enable them to find a job that pays enough to be able to live on. Just what the interviews like the man on the street asking college student simple question they have no clue and they don’t have basic knowledge how our government works.

I am so so tired of paying for the uneducated, and in this case, they are the Educated?

Yes, we are all sick of paying for the uneducated, even these people who went to college, but revived nothing except a chance to bill their credit cards for booze, girl friends who will sleep with them, and gambling debts. Let your parents pay for your college degree…..not the rest of us.

Second time this week I posted, and Larry took it down. WHY? What is your problem? You let Stetson say horrible nasty things, so what is your problem?

Why shouldn’t people pay their debts? The democrats are the party of deadbeats.

The problem isn’t even with the exorbitantly high tuition rates but with the compound interest charged on it. My son, after 20 years, owed more than he had borrowed, and it was all interest. And in a treacherous economy, he was not able to make the money he had been fooled into thinking he would make to be able to repay the loan soon. The only way he was able to get out of further extortions was to die. Have you heard of usury? Conning students into consenting to loans under those conditions is fraud. Protest is in order, against the interest gouging.

Kate Jones … You son is a prime example of the evil of the Student Loan Program. While i do not believe we can simply forgive billions of dollars in loans, there should be some way to address the most egregious abuses of the system. The Student Loan Program was much like the government created bubble that took down the housing market in 2008. Providing loans — for mortgages or tuition — that the person cannot afford is terrible policy. In the end it hurts more than it helps. You are correct about usury. We did away with those laws during dthe great inflation of the 1970s. And even as interest rates fell later, credit card interest did not.