OPEC Likes Those High Prices – Cuts Output by 2 Million BPD

As the Russia-Ukraine war continues, it is becoming clear that the true winners here are the oil-producing nations whose profits have skyrocketed as a result of the conflict.

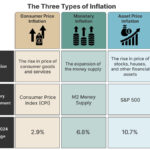

Oil-producing nations including Saudi Arabia saw a dramatic increase in revenue this summer before a downturn in recent weeks caused by fears of economic recession. International benchmark Brent crude hovered around 100 USD for most of the summer before dipping to 80 USD last week.

In March, the Biden Administration announced plans to release one million BPD from America’s Strategic Petroleum Reserve for six months. This week, the Administration said it would extend that plan to include an extra ten million barrels during the month of November.

This Wednesday, during OPEC’s first in-person meeting since the start of the pandemic, energy ministers agreed to cut production by 2 million barrels per day (BPD) – equivalent to 2% of the global supply. Brent crude immediately jumped to 93 USD.

Member states said the decision was due to the ‘uncertainty surrounding the global economic and oil market outlook’ and claimed Western opposition to the announcement was driven by ‘wealth arrogance.’ Saudi Arabia, which acts as head of OPEC, claimed it was not working in cahoots with Russia to keep prices high even though the kingdom has not condemned Moscow’s invasion of Ukraine.

The Vienna summit involved all 13 members of OPEC plus 11 additional oil-producing nations that make up the group known as OPEC+. Russia, which serves as co-chair of the latter organization, depends heavily on revenue from energy exports to support its economy. As noted by Energy Aspects executive Yasser Elguindi, Russia has rarely (if ever) advocated for production cuts.

This time around, the two million BPD reduction is expected to benefit Moscow ahead of EU sanctions banning nearly all imports of Russian energy. The sanctions, imposed over the invasion of Ukraine, are set to take effect before the end of the calendar year.

As analysts have noted, however, the true decrease may be closer to one million BPD given the fact that most oil-producing nations are failing to meet production quotas.

“[Russia] will need to find new buyers for its oil when the EU embargo comes into force in early December and will presumably have to make further price concessions to do so,” wrote analysts at Frankfurt-based Commerzbank. “Higher prices beforehand – boosted by production cuts elsewhere – would therefore doubtless be very welcome.”

Separately, the Group of Seven (G7) is trying to set a cap on the price of Russian oil by December 5th.

While the impact on American fuel prices is unclear, the production cut is sure to exacerbate widespread frustrations with inflation ahead of midterm elections. As noted by Fox News contributor Liz Peek, Americans’ opinion of the Biden Administration dropped significantly when oil prices rose this summer and improved when oil prices declined.

The timing of the cut could prove disastrous for Democrats and thrust Europe – which is already struggling with inflated fuel prices – into a recession.

Reasons OPEC would cut supply at such a fragile time include:

- Saudi Arabia’s frustrations with the Biden Administration – including President Joe Biden’s refusal to shake hands with the Saudi Prime Minister during a visit to Riyadh this summer, his decision to stop military aid to the war in Yemen, and his attempts to renew the nuclear deal with Iran

- Saudi Arabia’s desire for increased profits

- Russia’s need for additional revenue to fuel its war in Ukraine

- Retaliation for sanctions against Russia

- Attempt to balance supply after massive release from US oil reserves

OPEC agreed to cut output in May 2020 due to the pandemic but has gradually increased production since. As explained in my previous article (read more here), OPEC cut production by 100,000 BPD in October after boosting supply by the same amount in September. The oil-producing nations are scheduled to meet again on December 4th.

Author’s Note: The recent decision by OPEC+ sends a clear signal that oil-producing nations value profit over everything else and are willing to do whatever it takes to keep prices high. They have no sympathy for their customers and Europe is expected to suffer the most.

Sources:

Russia and Saudi Arabia agree to massive cuts to oil output. Here’s why it matters

OPEC+ agrees deep oil production cuts, Biden calls it shortsighted

OPEC+ weighs large oil cutback to boost sagging prices

OPEC+ Discusses Cutting Oil Output at Next Week’s Meeting

October surprise? Why OPEC’s planned price hike could pummel Democrats

Only a day late and a dollar short on this story.

Thanks for yesterday’s news.

Good thing Kushner already pulled his billions from the Saudi Prince Hack em Up. Payola for the Trump years policy decisions.

I wonder hiow much oil is required to make conventional or nuclear bombs?

I bet the process isn’t exactly green…

Tulsi Gabbard in 2024