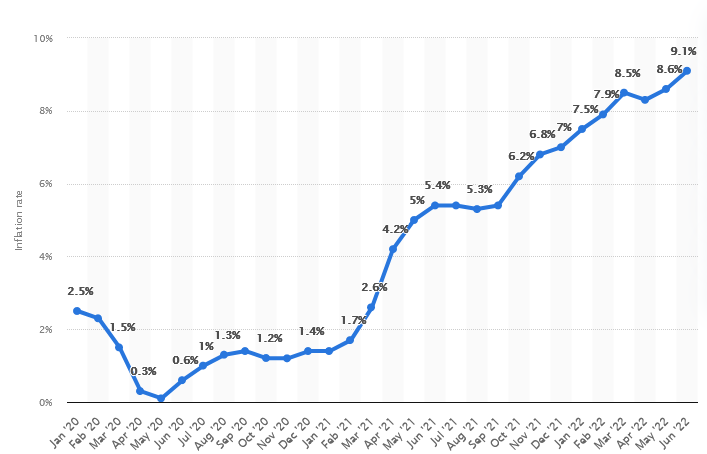

Inflation in US Reaches 40-Year Peak

Year-over-year inflation in the United States hit 8.6% in May and eclipsed 9% in June as food and fuel prices remained concerningly high, reports the Labor Department.

The Consumer Price Index (CPI) advanced 1% in May and 1.3% in June to produce the largest annual increase in inflation since November of 1981. The average price of gas jumped 11.2% from May to June to hit a new record high of over $5 per gallon before dropping slightly last week.

Core CPI, which measures inflation excluding food and energy, increased 0.6% in May and 0.7% in June. On an annual basis, Core CPI jumped 6% in May and 5.9% in June. Rents and mortgages, which represent 40% of Core CPI, were among the largest increases. As reported by the Wall Street Journal, May of 2022 was the most expensive month to purchase a home since 2006.

—

Analysts expected an uptick in inflation resulting from disrupted supply chains and the massive amounts of stimulus money granted to Americans during the pandemic, but Russia’s invasion of Ukraine has driven prices higher than expected – especially in regards to fuel.

Unemployment improved slightly in June with the addition of 372,000 jobs, but the labor market remains tight as companies struggle to fill vacant positions. Wages have increased as a result, driving up prices for goods and services and exacerbating inflation.

“Overall, this report confirms that the Fed will need to hike by 75 [basis points] again at the end-July meeting,” wrote Michael Pearce, Senior Economist with Capital Economics. “While some will draw parallels with the shockingly bad May CPI report, the backdrop is markedly different – commodity prices have fallen sharply and we’ve seen clearer signs of an economic slowdown, both of which will contribute to weaker price pressures ahead.”

Analysts’ predictions of a coming economic slowdown have already led companies like Target to cut prices as they look to shed unwanted inventory.

“There’s a pretty serious recession fear affecting a broad range of asset prices,” notes Laura Rosner-Warburton, senior economist at MacroPolicy Perspectives. “It would be really important if we do see discounting return, because it would show that we weren’t that far away from the pre-COVID environment in terms of pricing behavior.”

Editor’s note: You may recall that at the beginning of the year, I made some predictions about this. I said inflation would be higher than 10% for three or more months. I also said that the Fed rate would be limited to 1.5%.

Looks like the first prediction is pretty much happening.

But the Fed rate is already at 1.5% and it looks like they are planning to go higher. When I made the prediction, I assumed the Fed had some common sense and that they knew a higher rate would spur even greater inflation down the road because of the effect on our massive national debt. But recent revelations indicate that the Fed is led by idiots who had no idea this was coming. They may not be able to do the basic math required to make predictions here.

Look for the government to come up with some reason for you to not worry, some new inflation measure that says it is all OK. That will be the greatest mindf*&k of all.

Sources:

US Inflation Spikes to 9.1 Percent Amid High Gas Prices

We can thank Biden and his moron cult

We can also thank Trump and the largest deficit and debt in US history.

Amazingly he did one of the largest giveaways ever just before he lost the vote as it he was trying to buy it. Nice Whitehouse-warming gift for Biden.

That old fool doesn’t even know he’s in the White House. Only a fucking moron would think he’s smart enough to lead