Expect Higher Gas Prices as OPEC Cuts Output

The Organization of the Petroleum Exporting Countries (OPEC) has decided to reduce output by 100,000 barrels per day to normalize prices after boosting production in September.

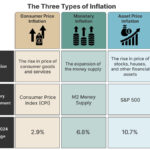

Though representing just 0.1% of global demand, the cut will be OPEC’s first decrease in production since 2020. Markets responded to the news immediately, with Brent crude futures jumping 3.9% (to reach $96.63 per barrel), US crude increasing 2.3% (to reach $88.85 per barrel), and West Texas Intermediate rising 3.6% (to hit $90 per barrel).

The reduction will begin in October, bringing output down to August levels after the bloc boosted production by 100,000 barrels per day in September. To mollify widespread concerns regarding gas prices, the coalition of 13 oil-producing nations said simply that it could meet at any time to adjust production levels.

“It’s the symbolic message the group wants to send to the markets more so than anything,” said Craig Erlam, an analyst with data currency calculator OANDA. “What we’ve probably seen from the markets was pricing in most of the worst-case scenario.”

—

The global demand for oil is expected to increase in the coming months as prices increase for electricity and natural gas. And while the Biden Administration has appealed to OPEC to increase output in order to lower the gas prices that are driving inflation in the US and Europe, oil producers including Saudi Arabia have refused.

Gas prices reached a peak in March after Russia invaded Ukraine but have dropped in recent months thanks to factors including: COVID-related restrictions, interest rate increases, anticipation of economic slowdown, and a possible revival of the nuclear deal with Iran (JCPOA).

This month, talks on the nuclear deal stalled yet again when the Biden Administration refused to submit to Iran’s demand that any agreement include the cessation of investigations by the International Atomic Energy Agency.

In the meantime, the Group of Seven (G7) has agreed to move forwards with plans to impose a price cap on Russian oil so that global supplies are maintained even as Moscow is punished for its invasion of Ukraine. As I wrote earlier this week, energy-starved Europe has been paying top dollar for “Chinese gas” that was imported from Russia and then resold.

Author’s Note: Saudi Arabia is refusing to ramp up production because it needs those higher prices to stay solvent. Saudi Arabia relies heavily on welfare programs and could face revolt if the government runs out of money to fund those programs.

In addition, OPEC member states have recently experienced a surge in revenue and want to keep things that way.

The world consumes oil at a fixed rate so even a small decrease in production can impact prices. OPEC’s decision to reduce output is particularly bad news for EU nations that are unable to import Russian gas due to sanctions.

Sources:

So much for Biden trying to get gas prices down before the midterms.

Thanks Joe. You moron

Gas was 3.28 at beginning of the year. It passed $5 and now is at $3.58

If you think we will notice a .1% production downturn in oul we do not import, come to NJ, I got a bridge to sell you.

Yes, other things have increased in price and inflation is not tame, and the Fed will put us into recession, hopefully short.

But right now, gas is down, it’s been trending down, and this story is fear mongering.