Recently, President Biden clenched his fist and emphatically yelled – yes, yelled – that America has the best economy in the world. That makes sense to politicians, economists and Biden supporters. It makes sense to the wealthy, who worry more about the value of their investments and stocks than the cost of their gas, cars, mortgages and groceries.

It was recently reported that Biden was asking his staff why the folks back home are not appreciating his great economy. I doubt anyone told him the real reason. They probably said things like, “we need better messaging.” Or “It will take time for the people to feel all the benefits.” Or “The media is not telling the people.” (That is a laugh when you consider how often Biden’s friends in the Fourth Estate keep promoting his version of the American economy.)

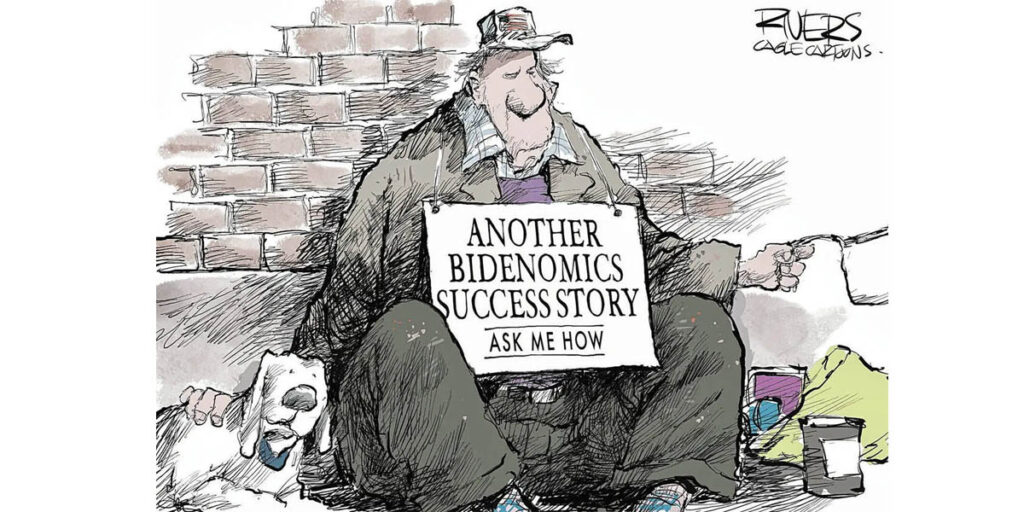

So … what is the real reason that the folks back home are not praising Biden on the economy as much as he praises himself? It is because they are not living in his rosy economy – and he is tone-deaf. We know he is tone-deaf because he keeps wondering why the people do not like his economy. They like the Trump economy better – according to virtually every poll. That just frustrates the hell out of Biden.

Mr. President. Here is your answer.

Those folks back home are not living in the economy you see or in which you and your friends live. They know the Gross National Product is good if it is growing, but where is the impact on their lives? They believe that creating new jobs is a good thing, but how does that relate to them? They hear you talk about the American economy being the strongest in the world. But they are not comparing their situation with some guy or gal in Italy. For families, economics is not a competitive issue. It is not a national issue. Those are headlines, but they are not the story.

For every individual and family in America, there is only one economy that matters. It is their personal economy – their family budget. Like a business financial report, people see their economy as their personal balance sheet – listing income on one side and expenses on the other. And they do not need professional accountants to do the books every year. It is in their head and in the bank accounts every day. They do the calculations every time they go to the grocery store.

More than two-thirds of Americans are living paycheck to paycheck. That means no savings. No putting money aside for those inevitable “rainy days.” No money for the kid’s college tuition. No money to purchase a home or a new car. No money for vacations. No money for retirement unless it is an employer provided. In fact, 13 percent of working Americans have no retirement funds.

Why do they see the Trump economy so much better. Because for them, it was. They tell us that in the polls. On average, two-thirds of voters believe Trump is better at handling the economy – their economy — than Biden. And there is a reason for that. They believe they were better off financially under Trump.

Ironically, Biden’s great economy is benefiting from the folks who are suffering. They have been contributing to those big -picture numbers – GNP, Jobs Reports, etc. – that Biden constantly refers to. Despite the high costs, people are using their money to purchase a lot of stuff. Consumer spending is driving the economy. Oh … did I say they were using their MONEY. Not so. They are using their credit cards – and while that helps Biden’s economy, it is crushing the personal economy.

It was recently reported that personal credit debt is at an all-time high of $1,13 trillion. That is an astonishing $50 billion increase in just the last quarter. The delinquency rate has risen by 50 percent in the same period.

The problem is compounded by the fact that interest rates on credit cards are averaging 21 percent – with many card holders paying much higher interest. (I recently received a solicitation for a card with an APR of 24.24 percent – and I have good credit.) Millions of card users will not qualify for the 21 percent average.

What is going to happen when consumers inevitably run out of credit? When can they no longer support Biden’s house-of-cards economy as consumers? Economic slow down? Stagflation? Recession? Whatever it is, it will not be good for the folks sitting around the kitchen table.

The credit statistics confirm that millions of Americans are falling in the credit trap – in which they can hardly afford to pay off the monthly interest. Getting debt free becomes a virtual impossibility. That means defaults, lower credit rating and higher credit charges in the future.

Having a job is not working for a lot of people. Since Biden took office inflation has driven costs up 18 to 19 percent. Wages over those years increased 16 to 17 percent. That means people today have less buying power than they did at the end of the Trump presidency. Even worse for them is that the inflation rate for the essential purchases – food, medicine etc. – is closer to 25 percent. That is what the folks back home are seeing and dealing with every day.

Inflation went up 3.1 percent in January – more than economists predicted. That means it is unlikely the Federal Reserve will lower interest rates. The news triggered a sharp decline in the stock market. Economists provided complicated – and often conflicting – explanations. But for the average person, it simply means the next trip to the supermarket will cost more than the last.

Biden touts his support for union pay increases. One can debate if they deserved increases — or how much the increases should be. But the one thing that is for sure is that those pay increases will eventually be reflected in the retail price tags. The significant increase for auto workers will be seen on the sticker price.

Biden can continue to brag about HIS economy, but he cannot jawbone what the folks back home are experiencing in THEIR economy. That is why all the talk about the great economy Biden has given us falls on deaf ears. The people know better.

So, there ‘tis.