President Biden Moves Forward with Tax Hike

President Joe Biden is moving forward with a proposed tax hike. It is expected to reverse many of the tax cuts included in President Donald Trump’s Tax Cuts and Jobs Act.

The changes will reflect promises made during Biden’s presidential campaign, including:

- Increased corporate tax rate

- Increased income tax rate for people making $400,000+

- Expanded estate tax

- Reduced tax benefits for pass-through businesses

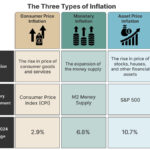

- Increased capital gains tax for individuals earning $100,000,000+

The additional tax revenue will be used to help pay for a massive infrastructure plan. It will cost as much as $4 trillion. Keep in mind Democrats just spent nearly half that much on a COVID relief packaged funded entirely by the national debt.

Senate Finance Committee Chairman Ron Wyden (D-OR) says another round of stimulus checks could easily be funded by the amount of revenue billionaires have made since the beginning of the pandemic.

“Sooner or later, we’ve got to pay,” said Senator Joe Manchin (D-WV). “Nobody likes taxes, I know that. Well, if you like your water and your sewer and your road and everything you receive and the food and all the amenities you have in life, maybe you better figure out how we’re going to be able to do it.”

—

The last major tax hike occurred in 1993 during the George W. Bush Administration. It was approved by just two votes in the House and required Vice President Dan Quayle to break a tie in the Senate. The vote on Biden’s proposal is expected to be just as close. Several Democrats are hesitant to support tax increases while unemployment remains high.

“People would accept the corporate tax raised a few points but beyond that you’re going to have problems, especially in the middle of an economic crisis,” said one Democratic Representative who asked to remain anonymous.

“Our tax system is a freakin’ disaster,” added Rep. Bill Pascrell (D-NJ). “[But] we’ve come through the pandemic [and] this is a tough time to raise taxes.”

To get the proposal past the Senate, Democrats will need support from at least 10 Republicans.

Elements of the proposal that could draw support from conservatives include:

- Replacing the gasoline tax with a vehicle-miles-traveled fee

- Additional funds for IRS enforcement

- Incentives for companies that keep jobs and profits in the US

“We’ll have a big robust discussion about the appropriateness of a big tax increase,” promised Senate Minority Leader Mitch McConnell (R-KY).

White House officials say they will suspend any major tax changes until 2022 to give Americans time to recover from the pandemic.

Sources:

Biden Plans First Major Federal Tax Hike Since 1993

Biden planning first major tax hike in almost 30 years: report

Joe, I realize that none of you folks that write for the windbag post are students of history, but tariffs…

Hello, mcfly, anybody home….. So, if you are in poverty and you get a helping hand, then you magically become…

Good luck Darren. Doubtful though.

Joe, exactly what don’t I understand about economics? I don’t remember you correcting me in the past and certainly not…

Joe, you just accurately recited Trump talking points. The problem is that almost all economists do not agree with Trump…