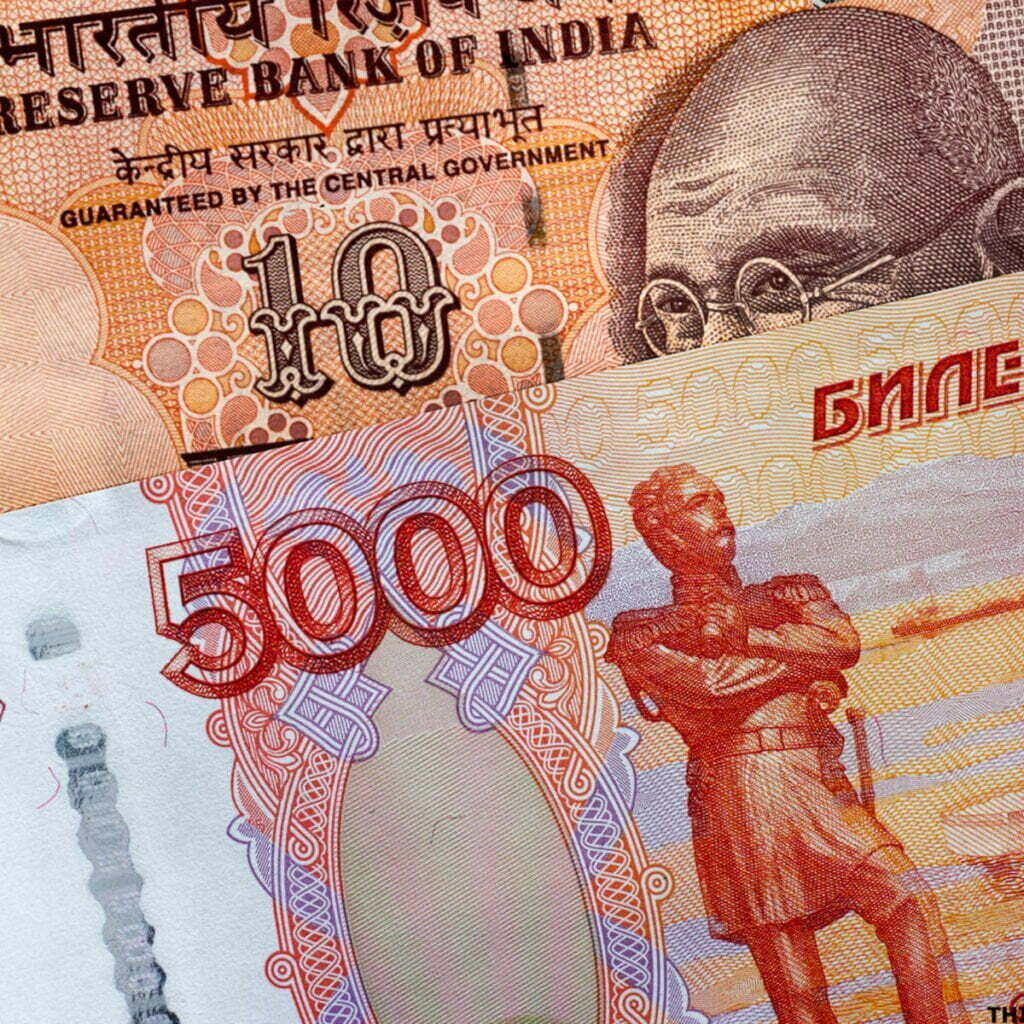

India is looking for creative ways to maintain trade with Russia despite sanctions imposed over the invasion of Ukraine. One option is to revisit the rupee-ruble agreement put into place in 2014 when India faced sanctions over a weapons deal with Moscow – though US officials last week threatened to sanction India over the deal.

New Delhi is also looking to work with minor Russian players not affected by the SWIFT ban and foreign financial institutions located in nations that do not support the sanctions against Russia.

India is expected to look to Gazprombank and Sberbank – two major Russian banks exempted from the SWIFT ban due to their key role in the oil and gas industry – to make settlements. Another option reportedly being considered is a rupee auction (hosted by Russian banks) to repay Russian debts by way of exports.

SWFIT (The Society for Worldwide Interbank Financial Telecommunications) is the primary communications network used by major banks throughout the world. Two days after Russia moved against Ukraine, the US teamed up with Canada and EU allies to block some Russian banks from using the network. For now, these banks cannot use SWIFT to transfer money or exchange information.

As noted by Washington Post contributor Carla Norrlöf, however, the SWIFT ban does not prevent sanctioned banks from working with the thousands of financial institutions outside the network. Banks outside the network that do not face sanctions are free to utilize alternative messaging systems to settle payments.

Author’s Note: India’s decision to prioritize its economy over the health and safety of Ukrainian civilians essentially means that India has sided with Russia. This is a major development that could affect geopolitical relationships for decades and yet has been ignored by the mainstream media.

Sources:

How India and Russia Are Planning To Bypass The Dollar

India wants to bypass dollar to keep trading with Russia

Banning Russia from SWIFT is a big deal. But the real pain comes from sanctions.