President Biden is making a second attempt to buy votes with taxpayer money by making you and me pay for $146 billion in student loans. This, despite the fact that the United States Supreme Court – in a 7 to 2 decision – declared Biden’s previous abuse of power unconstitutional less than a year ago. (Incidentally, the Biden student loan proposal would cost taxpayers more money than the proposed legislative aid package for Ukraine, Israel and to secure the southern border COMBINED.)

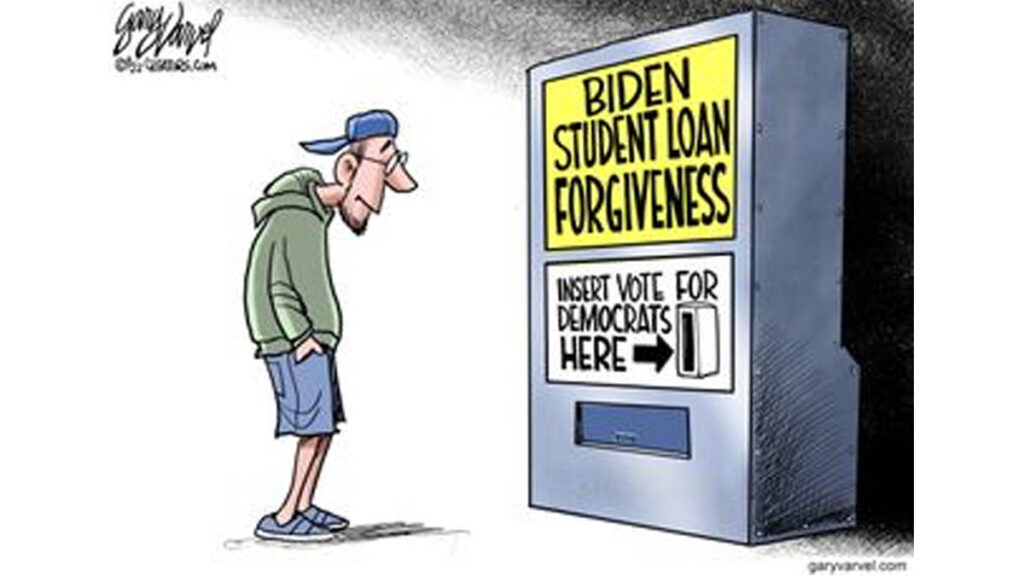

You might think that the Supreme Court decision would have settled the matter. But nooooo! Biden & Co. searched for alternatives to finance their bribes-for-votes scheme –one they hoped would pass Supreme Court muster. Now they claim they have one.

The Biden Scheme

The new scheme has several basic provisions. It would:

- Forgive $20,000 in interest for millions of borrowers.

- Forgive the debt to those pleading “hardship.”

- Forgive repayment of 20-year-old loans to those with undergraduate degrees – and 25 year old loans by graduates.

One of the more interesting provisions is the automatic cancellation for eligible students who have not yet applied. Not sure how that works.

According to Education Secretary Miguel Cardona, in a CNN interview, debt cancellation would also apply to students who did not get fair value for the education provided. He is obviously thinking of the so-called “degree mills.” But could that be applied to Harvard or Yale? A lot of those students would say “yes.”

Cardona also indicated forgiveness would apply to loans in which the interest is now larger than the loan. Of course, that means the borrower has not been paying off their loan. Potentially the deadbeat gets the greatest benefits.

Viva la difference

So, how does this plan differ in terms of the Constitution – which Biden’s last plan violated?

According to Biden, the new scheme is more targeted. His original effort was to cover 43 million borrowers in a blanket approach. The new plan covers approximately 25 million borrowers based on specific conditions – such as older loans, unpaid loans or personal hardship.

The old plan was based on the Heroes Act. In the new scheme, Biden is attempting to use the federal rulemaking process. The legitimacy of this effort will likely again be brought to the Supreme Court. Already three state attorneys-general have filed suits against the new plan.

As in all situations, there are lawyers on both sides. It appears from media reports, however, that most legal scholars believe the Supreme Court will view Biden’s new effort as a difference with a distinction.

What is so bad about forgiving the loans?

Outside of Biden’s political self-interest and the schemes questionable constitutionally, it is a very bad idea on its own merits.

Basically, Biden is arguing that the President of the United States has the authority – by Executive Order – to shift the obligations of student loan recipients onto the American taxpayer. In other words, Uncle Sam (you and me) will pay off the financial obligations of millions of students.

What is noteworthy in the Biden scheme is that not only will the students be free of legally incurred debt, but the Banks will be made whole. In addition, there will be no collection problems for all those lenders.

The Universities that sucked the financial blood out of the students – and were the greatest beneficiaries of the god-awful Student Loan Program — will not suffer any losses. There can be no argument that the Biden deal will benefit a lot of students, the lending institutions and the universities. So, who gets hurt. Just about everyone else.

The most obvious is the American taxpayer who will be paying the bill. We get screwed. We will either see our taxes go up to pay off the debts – or Uncle Sam will have to borrow the money. The latter is the most likely since we are already billions of dollars short of paying our federal government bills. Just check out the deficit and the National Debt. The Washington establishment no longer TAXES and spends, it BORROWS and spends.

It is not just the matter of shifting the burden from the borrower to the taxpayer. No. No. No. It is not just a matter of trashing the Constitution. No. No. No. The entire plan is ruthlessly pragmatic politically and unconscionably unfair.

It is a slap in the wallet of all those who have dutifully paid off their student loans. And now Biden wants them to help pay off all those other students’ loans – including the deadbeats who have compiled lots of interest or penalties. And what about all those students who tightened their belts and avoided taking out student loans – especially those 6-figure loans? They would be paying for student loans they neither applied for nor received. And of course, those who did not go to college are now paying off other people’s college educations.

Student loan recipients are also victims

Biden’s scheme is wrong constitutionally and wrong politically. However … that is not to say that the individuals with unpaid student loans are victimless. The entire Student Loan Program was designed to make them victims.

They were merely the conduit through which taxpayer money flowed to the colleges and universities. The loans were essentially a taxpayer gift from the progressive D.C. establishment to their progressive academic constituents.

The Student Loan Program enabled the major academic institutions to raise their tuition and other costs far greater than inflation. More money means higher prices. That is why the Student Loan Program provided money FAR in excess of the needs of the student and the university. It provided a windfall for the colleges and universities – and they sucked in the money with a vengeance with much higher-than-inflation increases in tuition and other charges.

To appreciate the magnitude of academia’s treachery in this matter, consider the astronomical costs of today’s education – tuition and other costs — at top universities. Harvard is currently at $83,000, Princeton $87,000, Yale $91,000, Brown $92,000, Wellesley $92,000, Tufts $96,000. And that folks is PER YEAR! It was the Student Loan Program that has enabled schools to charge such exorbitant rates.

Imagine … four years at Tuft University for $384,000 dollars. Even with scholarships and university-provided financial assistance, the amounts students are required to pay are outrageous. The market value – in terms of postgraduate salaries — of even those elitist educational institutions is simply not worth it.

Less prestigious schools – and even the “diploma mills” – have also unfairly benefited financially from the excesses of the Student Loan Program.

It is one thing to recognize that the student loan recipients were screwed by the loan program and another to shift that burden and screw the taxpayers. Any correction applied to the problem should rest on the shoulders of those who had the most wrongful gain – the colleges and the Universities.

My approach would be to pass legislation essentially requiring a partial refund on ALL student loans. I would also restrict the levels of student loans to make less money available for such obnoxious tuition increases. I would also use the federal grants to colleges and universities – and there are a lot of them – to force a reduction in tuition and other costs. This may require the largest universities to dip into their multibillion-dollar endowment funds that were so greatly enhanced by the Student Loan Program.

Final note

If the Biden plan were to pass Supreme Court muster – which I personally doubt — when would the first student loans be forgiven? According to the White House “sometime in the Fall.” The first thing to understand is that means it will not happen until sometime in 2025 – and certainly not before the November presidential election.

That is significant. I suspect Biden knows that his plan will not be approved by the Supreme Court – and that could take months. Consequently, he will be peddling his student loan forgiveness scheme as a campaign theme – whether it becomes real or not. By the time the student loan recipients learn that they are not getting any of their loans forgiven, the November election will be over. Biden is not only selling a pig in a poke but likely selling a dead pig.

So, there ‘tis.