Beijing’s Securities Regulatory Commission is working on a new policy that could force foreign-owned businesses operating in China to incorporate and answer to Chinese Communist Party (CCP) cells.

For years, all Chinese companies (whether public, private, or non-profit) with at least three party members have been strongly encouraged by the government to form such cells. In 2018, Chinese President Xi Jinping announced a policy requiring companies to maintain CCP cells in order to be listed on domestic stock exchanges.

Members of CCP cells are responsible for staying up-to-date on approved political theories, recruiting additional party members, reporting illegal activities, providing welfare assistance to workers, and organizing social events.

State-run businesses in China were compelled to organize CCP cells in 2016 and party members have been approaching foreign-owned businesses about forming cells since 2018.

In 2020, the General Office of the Communist Party’s Central Committee issued an opinion piece calling on United Front Work Departments to “guide private enterprises to improve their corporate governance structure and explore the establishment of a modern enterprise system with Chinese characteristics.”

What this means is that Beijing is calling on CCP cells to get involved in personnel management and decision-making.

When the opinion piece was published, the European Chamber of Commerce in China warned that forced inclusion of CCP cells could “have a considerable impact on business sentiment and could lead foreign companies to reconsider future and even current investments in China.”

Roughly 48.3% of eligible Chinese companies have CCP cells, up from 27.4% in 2002, and that number jumps to 92% among China’s top 500 private enterprises. Traditional industries like manufacturing tend to have the highest percentage of CCP cells and large corporations are expected to appoint full-time CCP secretaries that work directly with company leaders.

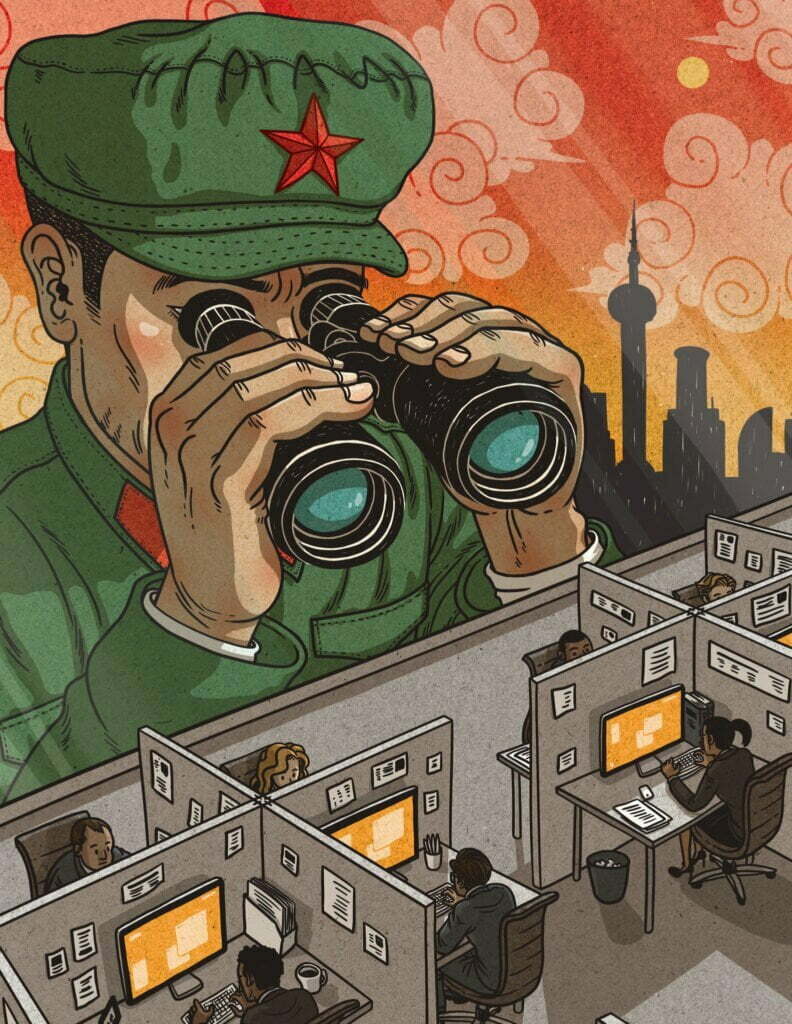

CCP cells are highly organized by district with a clear chain of command ending at Beijing’s Standing Committee of the Central Political Bureau – which is of course led by President Xi. CCP infiltration of the private sector is a priority for Xi, who can use it to move forward on policy goals including increased surveillance.

For years, the pressure on foreign-owned businesses to cooperate with party members was viewed simply as the price of doing businesses in China. But now, given Beijing’s increasing human rights abuses and territorial aggression, the risks of this partnership are higher than ever before.

If major companies like Fidelity and BlackRock are compelled to work with CCP cells, shareholders will have no way of knowing whether major decisions are being influenced by the Chinese Communist Party and the result will be a very unhealthy relationship between Chinese domestic political risks and the West’s financial industry.

We can also expect a massive increase in intellectual property theft as CCP cells attempt to force technology transfers from foreign-owned businesses to Chinese subsidiaries.

The pressure on foreign-owned businesses to incorporate CCP cells is a bold move, even for China. And the exertion of government control over private industry represents a dangerous shift towards fascism, which can be defined as “a political system headed by a dictator in which the government controls business and labor and opposition is not permitted.”

Editor’s Note: This shows how communism and socialism eventually lead to fascism, which is the control and use of private companies for government purposes. This needs to be checked and checked quickly. Unfortunately, the current President isn’t up to the task.

Sources:

Chinese Communist Cells in Western Firms?

Influence without Ownership: The Chinese Communist Party Targets the Private Sector