Good economic report … but it won’t last

The first two quarters of 2022 indicated that the American economy had slipped ever so slightly into a recession – according to the classic definition of two negative growth quarters. As anticipated by the economic gurus, the third quarter was going to have growth. They estimated it around 2.3 percent. It did better than that at 2.6 percent.

Politically that is great news for President Biden and the Democrats. They can claim – on the eve of the Midterm Election – that the economy has turned around and their programs are working.

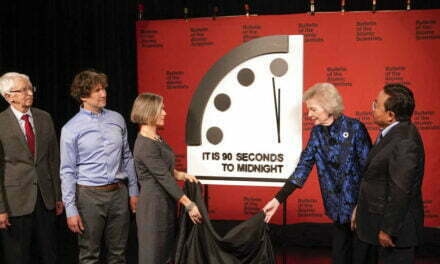

Unfortunately, that is not the case. What we are experiencing is a “double-dip inflation.” If you look at the last month of the quarter, you will see the beginning of another slowing down. The Federal Reserve is still expected to increase the interest rates again by 75-basis points.

If anything, the third-quarter good news is bad news in terms of inflation … and that means the Fed needs to cool down the economy … and that means a very probable future recession. How bad it will be is being debated by the economists, the bankers, and the politicians – but there is almost universal agreement that there will be a recession in the near future.

The just-released economic report is a lot like the difference between today’s weather and climate change. The third quarter produced some sunshine, but the economic storms are still on the horizon.

While Biden will praise and take credit for today’s good news – as any President would — it is still not all good news. The inflation is still raging – prices are still climbing. And the Fed’s “cure” is not going to help the average consumer in the short run.

Raising the interest rates hits hardest on those using credit cards – or planning to make a major purchase, such as a car or a house. In fact, the increases in mortgage costs are already depressing the housing market.

To understand the severity of the impact, consider this. Your monthly payment on a $400,000 house today would have purchased you a $700,000 home at the beginning of the Biden administration. Put another way, mortgage rates have almost doubled – and are likely to go higher.

While the voters may be HEARING the good news from the economists and the Democrats, they are not experiencing it. The economic problem for the average American is still getting worse. Biden says things will now be getting better in the future. The economists and the bankers – even the Federal Reserve – are anticipating a worsening economic situation in the future.

In planning your economic future, you would be wise to listen to the economists and the bankers.

So, there ‘tis

I suspect we will be hearing this “good news” a lot from MSM between now and Nov. 8th.

Yeah, gdp growth is fake news that the dems made up. Never happened. Same with unemployment. It’s really much higher. Msm lies. It’s all fake.

Ben is back. … the only lies are when you suggest that I did not use the correct government figures on the economic growth in the third quarter and the unemployment rate. While they are “positive” as opposed to a decrease in growth, but they will not impact positively on most people — and by all indicators, will be short lived. And the employment rate is a mixed bag since the Fed is trying to increase unemployment to reduce inflation by reducing spending. The economy is in a very tough position — and Biden economics of spend, spend, spend is not helping. But then I know you know nothing about how the economy really works. That is why you are so gullible when it comes to Biden’s good news messaging.

Ben is back … you’re getting Larry’s dander up on the subject he takes to the bank no holds barred.

If you, Frank, Mike, Moe, or Curly reply contrary a rebuttal is a sure follow up.

Facts are facts and numbers are only numbers until they’re not and it gets political.

At the present just a handful who reply on PBP keep it civil. Which should please Larry & Co as advocates of free speech on postings.

Mature adults understand, one’s personal freedoms end where another’s begin and civil respect shown used to be expected when the two overlap. Sadly, to few are in agreement where and when the overlap occurs. Apparently, there is no generally accepted basic code of ethics known , therefore not practiced.

Following media commentary produced by either party’s speakers with reply comments, quickly illustrates how far down into the many rabbit holes people are willing to go. Then, while down in the hole aggressively believe in their story as true and authoritative.

That’s really odd, claiming authority on something means identifying as an expert on the subject. Now, not many people, these days, trust or listen to those claiming expert status.

Go figure, who or what source rises to one’s truth level for belief in facts asserted. The Who or What sources turned to and believed originates in the degree of complexity to which one’s view of their world is shaped. How many people know what a worldview is or think they have one? What is one’s personal philosophy consist of?

What one identifies as, essentially, describes a philosophy. Then, too, a world view appears.

Complexity relative to a person’s decisions on sources believed often becomes judgmental in nature. For that part I claim no expertise.

I may not have the economic where-with-all of Larry, but certainly I would agree that Biden is gilding the lily and lying in his painting of a the picture. Just as Larry is in his whacked prognostications. He does not know and is purely guessing.

My guess?

Hey, I have sold most equities, engaged in brokered CDs, commodities, tax free shelters, and inflation-based mutuals. Still hurting, but not that bad. My guess is recession, just who knows how long, how bad. It’s already world-wide, that’s not good.

We will see unemployment go up. We filled pandemic gaps, now pandemic demand is down, it’s natural. But it’s on top of world-wide inflation where America can only claim we are better, we are Queen of the PIGS. The FED will continue to up the rates, slow spending, increase unemployment and most certainly, overcorrect. How far is the question. They are attempting to scalpel cut with a chain saw of a cutting tool. “The economy is in a very tough position” is good as gold in my book, but blaming Biden and the Democrats is as crazy as saying Trump was totally responsible for the good economy on his watch.

In any other period, Larry would be the first to say that the President does not control the economy much less the nuts n bolts like inflation. But if spending is the problem, it started with Trump, reaching the highest levels ever in our history, dollars or %’s, in 2020. Including his trillion dollar Xmas 2021 spending surprise he dumped in Biden’s lap in his shameless attempt to win the Presidency, the whore.

That said, Frank says……

– watch luxury goods, even slight ones, for deals. I already see that their inflated prices are putting the squeeze on orders and therefore revenues. You can see more and more sales, and if you know your prices, can snag some deals. Even on things like Larry’s State’s Hale Grove, off-the-tree fruit are having more sales than normal.

– mortgages are up, but many times prices drop to have the bottom monthly payment lowered. If you know your prices, you might be able to snag a deal as demand cools. Same with boats, rv’s, atv’s, you got the drill — luxury and semi luxury will discount first. Gas and other commodities, probably latter, if at all.

– if you’re young, hang on to your investments and ride it out. It may take a couple years if a bad one, we hope not. If you are old, sorry, probably too late if you haven’t moved already. May want to sell some at breakeven or close too if you need the cash from now over the next year or so, depending on the recovery.

– make your next purchase better on the oil, it’s only going to get worse. In 2010 I love my hybrid, by 2016 I hated it, and now in 2022, I am in love again! 50mpgs is berry, berry goot even if I can’t accelerate or corner…..

– There’s time to hate Biden spending and there’s a time to capitalize on the Fed’s helping hand. There’ $9B out there in Home Energy Improvement Programs, defined at the State level. Find them and, if beneficial, use them to save money. I used Obama’s and now I spend less for more heat. I am at 73-75 most of the winter because it’s a huge saving over pre-improvements, and I like it. You can run break-evens on most of this, and most of mine paid off in a year, some at two years. I used Home Improvements, Cash for Clunkers, State rebates on hybrids, refrigerators, ac upgrades, freezer, and more. They even sent me a bunch of free lights. You can bitch at budget time, for now the die is cast, use it if you can profit.

That’s all for now, but remember, with every challenge comes opportunities. Any PBP-ers have more? Shanghai Larry’s tome here and let him know.